'U.S. Tariffs' Ignite Shift... K-food Growth Axis Moving Toward Europe

- Input

- 2025-10-09 15:29:40

- Updated

- 2025-10-09 15:29:40

[Financial News] With the intersection of mutual tariffs between the United States (U.S.) and Korea and the rising popularity of K-food, the global growth axis of the domestic food industry is shifting toward Europe. The strategy of diversifying exports beyond the traditional core market of the U.S. to Europe and other regions is gaining momentum. However, Europe’s stringent food regulations and the need for localization strategies have emerged as key challenges that will determine the success of K-food in the region.

According to the Korea Trade Statistics Promotion Institute and industry sources on the 9th, the impact of tariffs imposed by the Donald Trump administration in the U.S. is becoming a reality across industries, raising concerns for K-food exports to the U.S. In July, exports of agricultural and processed foods such as ramen and snacks to the U.S. totaled $139 million, a decrease of $10 million (6.7%) compared to the same month last year.

This marks the first year-on-year decline in agricultural food exports to the U.S. since May 2023, a span of two years and two months. Exports in August also fell by 4.4% year-on-year to $132 million.

The decrease in agricultural food exports to the U.S. is attributed to companies advancing their orders ahead of the high mutual tariffs imposed in August. The U.S. remains the largest export market for Korean agricultural foods, accounting for about 16% of total exports.

As trade risks from U.S. tariffs become more prominent, the food industry is increasingly viewing Europe as a new growth axis. In fact, exports of agricultural foods to Europe are showing remarkable growth. According to the Ministry of Agriculture, Food and Rural Affairs, K-food exports to Europe in the first half of this year reached $421 million, up 23.9% from the same period last year.

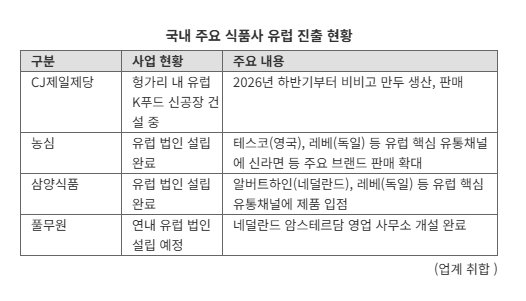

CJ CheilJedang is currently building a new K-food plant near Budapest, Hungary. From the second half of 2026, the company plans to produce bibigo dumplings for sale in the European market and later expand production lines to include bibigo chicken.

Last month, Lee Jae-hyun, chairman of CJ Group, visited London, United Kingdom (UK), marking his first on-site management activity in Europe to assess business expansion opportunities. He stated, “Following the U.S., which is a global business hub for the group, we must actively seek new growth opportunities in the European market, which has great potential.”

Leading K-food companies in the ramen sector are also accelerating their efforts to penetrate the European market.

Nongshim aims to expand sales of key brands such as Shin Ramyun through major European retail channels, including Tesco plc (UK), REWE (Germany), Albert Heijn (Netherlands), and Carrefour (France and throughout Europe). To this end, Nongshim established its European subsidiary, Nongshim Europe B.V., in Amsterdam, Netherlands, in March. The company’s goal is to achieve $300 million in exports to Europe by 2030. Samyang Foods also established its European subsidiary in Amsterdam in July last year. Additionally, Pulmuone opened a sales office in Amsterdam and plans to establish a European sales corporation within the year.

Notably, from the 4th to the 8th (local time), major Korean food companies participated in Anuga 2025, the world’s largest food fair held in Cologne, Germany, to explore opportunities for expansion into Europe. Participating companies included Namyang Dairy Products, Nongshim Taekyung, Daedoo Foods, DAESANG CORPORATION, LOTTE WELLFOOD CO., LTD., Lotte Chilsung Beverage, Binggrae, Sempio Foods Company, Origin Gourmet, Young Poong Group, Paldo, Pulmuone, and HARIM Co., Ltd.

However, increasingly stringent food regulations in Europe remain a significant hurdle. Since February, the European Union (EU) has tightened regulations requiring the disclosure of nearly all information on production processes and ingredients for the sale of Novel Food. This year, some European countries have also begun discussions on introducing warning labels for ultra-processed foods (UPF).

An industry official stated, “To target the European market, which values traditional food culture, it is more advantageous to emphasize Korea’s traditional food culture and health benefits rather than simply focusing on functional convenience or innovation. As it is a market where it is difficult to build trust in new foods or technologies, companies should aim for long-term trust-building rather than short-term sales growth.”

ssuccu@fnnews.com Kim Seo-yeon Reporter