Seoul Apartment Prices Rise for 32 Consecutive Weeks.. 25 Districts Up, Seongdong-gu 0.27% Top

- Input

- 2025-09-11 14:00:00

- Updated

- 2025-09-11 14:00:00

Seoul Sale Prices Up 0.09%·Jeonse Up 0.07%

Seongdong-gu 0.27% Top.. "Demand for 'Smart One' Remains"

Seongdong-gu 0.27% Top.. "Demand for 'Smart One' Remains"

[Financial News] Seoul apartment prices have risen for 32 consecutive weeks. Experts believe that this statistic, based on September 8, right after the announcement of the '9·7 Real Estate Measures', had no direct impact on the market. However, with the forecast of prolonged transaction contraction due to stricter loan regulations, attention is focused on the trend of house prices.

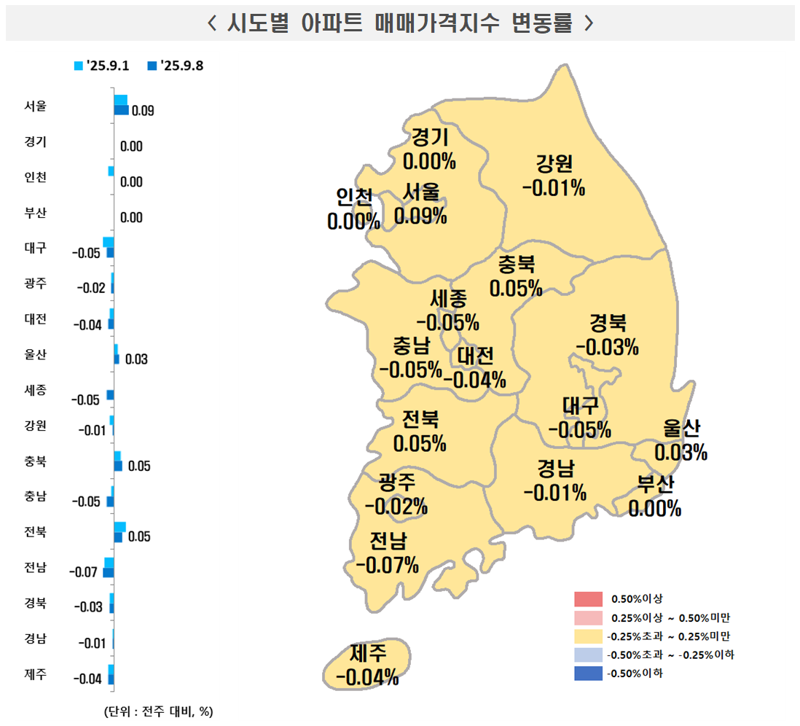

Korea Real Estate Agency announced on the 11th that according to the 'Weekly Apartment Price Trend for the 2nd Week of September 2025 (as of the 8th)', Seoul apartment sale prices rose by 0.09%, up 0.01%p from the previous week (0.08%). Seoul apartment prices have been on an upward trend for 32 consecutive weeks since turning upward at 0.02% in the first week of February. It peaked at 0.43% on June 23, but the rise in house prices slowed down after the 6·27 loan regulation, continuing with slight fluctuations.

■All 25 Districts Rise.. Seongdong-gu 0.27% Highest

All 25 districts in Seoul saw an increase in apartment prices, with 16 districts expanding their increase, 6 maintaining their increase, and 3 reducing their increase.

Regions with expanded increases include Seongdong-gu (0.27%), which rose by 0.07%p, Gwangjin-gu (0.20%), Mapo-gu (0.17%), Jung-gu (0.16%), Gangnam-gu (0.15%), Yongsan·Seocho-gu (each 0.14%), and Yangcheon-gu (0.10%).

Six districts, including Gwanak (0.09%), Dongjak (0.07%), and Gangseo (0.05%), maintained their increase. On the other hand, Songpa-gu (0.14%) decreased by 0.05%p from the previous week (0.19%), and Seongbuk-gu (0.04%) and Gangbuk-gu (0.01%) also slightly slowed down.

In terms of the increase rate itself, Seongdong-gu was the highest at 0.27%, followed by Gwangjin-gu (0.20%), Mapo-gu (0.17%), Jung-gu (0.16%), and Gangnam-gu (0.15%). Songpa, Seocho, and Yongsan-gu also rose by 0.14% each, driving the market.

The Real Estate Agency explained, “Despite the contraction in transactions, buying continued to focus on redevelopment-promoting complexes and large complexes near subway stations.” Representative rising areas include Daechi and Gaepo-dong in Gangnam-gu, Banpo and Jamwon-dong in Seocho-gu, Geumho and Oksu-dong in Seongdong-gu, Gongdeok and Sangam-dong in Mapo-gu, Gwangjang and Jayang-dong in Gwangjin-gu, and Ichon and Munbae-dong in Yongsan-gu.

The apartment prices in the metropolitan area rose by 0.03%, up from the previous week (0.02%). Incheon turned from -0.04% to flat, and Gyeonggi maintained its flat trend. Nationwide apartment prices turned upward at 0.01%, while the provinces maintained the previous week's decline (-0.02%). Sejong turned from flat to a decline of -0.05%.

■Jeonse Market Also Strong.. "Difficult to Expect House Price Stability"

The jeonse market also continued its strength. Seoul apartment jeonse prices recorded 0.07%, the same level as the previous week. Rising transactions were observed mainly in preferred areas such as school districts and areas near subway stations, including Songpa-gu (0.23%), Gangdong-gu (0.14%), Yangcheon-gu (0.12%), Yongsan-gu (0.11%), and Seocho-gu (0.09%). The metropolitan area rose by 0.04%, up from the previous week (0.03%), and nationwide jeonse prices also rose by 0.03%, up from the previous week (0.02%).

Meanwhile, experts diagnosed that the impact of the Lee Jae-myung government's housing supply and demand suppression measures on market stability would be limited. Choi Won-cheol, a special professor at Hanyang University's Graduate School of Real Estate Convergence, pointed out, "The preference for 'smart one' is still clear, especially in high-grade areas such as the three Gangnam districts, making it difficult to expect stability in Seoul's house prices with mere supply expansion."

Lee Eun-hyung, a research fellow at the Korea Construction Policy Research Institute, said, "The 9·7 real estate measures focus on strengthening loan regulations for multi-homeowners and homeowners, but the proportion of those who take out jeonse loans while owning a home and living elsewhere is not large in the overall market, so the direct impact is not significant." He added, "The possibility of a house price decline remains low, and as ultra-high-priced transactions continue actively, polarization within the market is expected to deepen."

en1302@fnnews.com Jang In-seo Reporter