"Won Stablecoin Must Be Equipped for Domestic and International Exchange Listings" [Crypto Briefing]

- Input

- 2025-09-08 16:43:30

- Updated

- 2025-09-08 16:43:30

KakaoBank Song Ho-geun, Deputy President, Presents at Democratic Party Ando-geol's Policy Forum

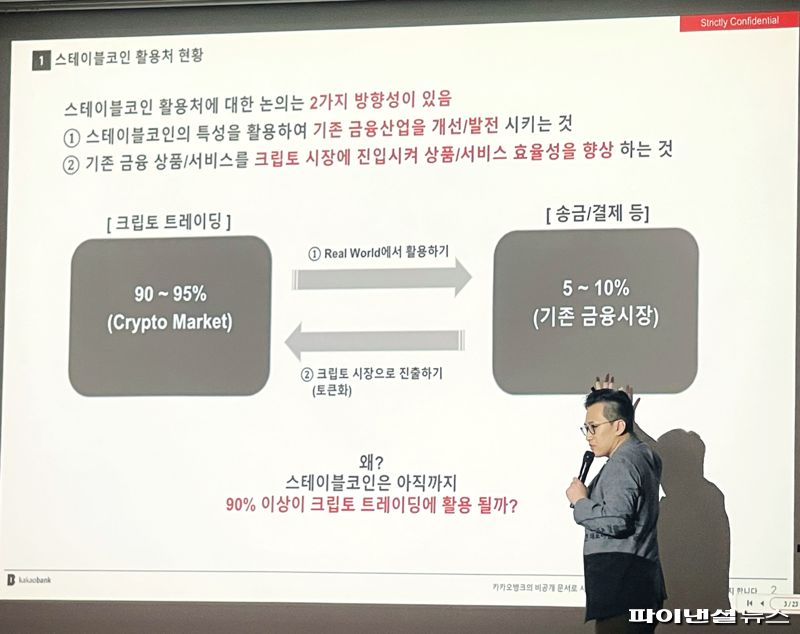

[Financial News] It is anticipated that if a won stablecoin is issued, it will replace a significant portion of domestic dollar stablecoin trading volumes. With over 90% of dollar stablecoins issued by Tether (USDT) and Circle (USDC) being used in virtual asset trading, it is argued that if a licensed won stablecoin can be listed on domestic and international virtual asset exchanges with legal and technical capabilities, it can be used like a base currency without exchange rate risk.

KakaoBank Song Ho-geun, Deputy President (Investment & New Business Group), stated at the won stablecoin forum hosted by Democratic Party member Ando-geol on the 8th, "As a result of the rapid increase in dollar stablecoin trading volumes in the domestic top 5 won markets such as Upbit and Bithumb, the dollar stablecoin trading volume reached 57 trillion won in the first quarter of this year," and pointed out, "Despite being exposed to exchange rate fluctuations, dollar stablecoins are used due to the absence of a won stablecoin." He added, "If a won stablecoin is issued, it can be used as a base currency for the convenience of virtual asset trading."

For a won stablecoin to be listed on domestic and international exchanges, the industry consensus is that issuance rights should be granted to a consortium involving banks and fintech companies. Regarding this, Deputy President Song stated, "The joint venture (JV) and qualified institutions responsible for issuing won stablecoins should be given stringent management, supervision, and responsibility equivalent to financial institutions, and flexible regulations and institutional support measures should be prepared to activate the distribution ecosystem."

At the forum held ahead of the Democratic Party's virtual asset task force (TF) launch, presentations and panel discussions were held on topics such as △The Future of Stablecoins and Digital Finance △Stablecoin Use Cases △Measures to Prevent Money Laundering with Stablecoins. Prior to this, Ando-geol, who proposed the legislative bill to institutionalize 'Value-Stable Digital Assets (Won Stablecoin)' (Act on the Issuance and Distribution of Value-Stable Digital Assets), planned this series of forums with fellow party members Kim Tae-nyeon, Park Hong-geun, Jin Seong-jun, Min Byung-deok, Lee So-young, Lee Jeong-moon, Jeong Il-young, Jeong Tae-ho, Kim Nam-geun, Kim Hyun-jung, and Lee Kang-il under the theme of 'Solutions for the Utilization and Expansion of Won Stablecoin'.

The industry showed high interest in Deputy President Song's presentation. As Kakao Group has formed a stablecoin task force (TF) centered around the CEOs of Kakao, KakaoPay, and KakaoBank, KakaoBank has shown the most active moves, such as participating in the central bank digital currency (CBDC) test promoted by the Bank of Korea. KakaoBank's application for trademark rights related to stablecoins such as 'KKBKRW' and 'KRWKKB' at the Patent Office is also in the same context. KakaoBank, which is the real-name account partner bank of the virtual asset exchange Coinone, also provides a 'virtual asset price inquiry' service through its application (app). This suggests that KakaoBank can play a key role in the won stablecoin ecosystem.

Deputy President Song also presented five characteristics of stablecoins, expecting innovation in financial services. The main characteristics include △Value exchange equivalent to legal currency (value stability) △24/7 real-time transactions (digital native) △Proof, audit, and real-time verification through all transaction records left on the blockchain ledger (transparency) △Automatic settlement and purpose-limited use through conditional automatic contract execution (smart contract) (programmable assets) △Instant cross-border remittance and international trade/payment utilization through connection with other virtual assets (global compatibility).

Deputy President Song emphasized, "Discussions on the use of stablecoins should focus on developing the existing financial industry by utilizing the main characteristics of stablecoins and increasing efficiency by introducing existing financial products/services into the crypto market."

In this regard, the Democratic Party and financial authorities, including the government and ruling party, are also making all-out efforts not only to incorporate won stablecoins into the institutional framework but also to activate distribution. Ando-geol said, "In overseas countries like the United States and Japan, various use cases are emerging beyond the institutionalization of stablecoins," and added, "We should also actively discuss various measures such as integrating K-content and tourism industry with won stablecoins and utilizing stablecoins for internal remittances by global companies like Samsung Electronics."

elikim@fnnews.com Kim Mi-hee