Samsung Electro-Mechanics, Full Operation of MLCC Production... Smooth Sailing in Q3 Performance, Daishin Securities

- Input

- 2025-09-02 06:00:00

- Updated

- 2025-09-02 06:00:00

Double-digit growth in operating profit this year

Expected to join the '1 trillion won club' next year

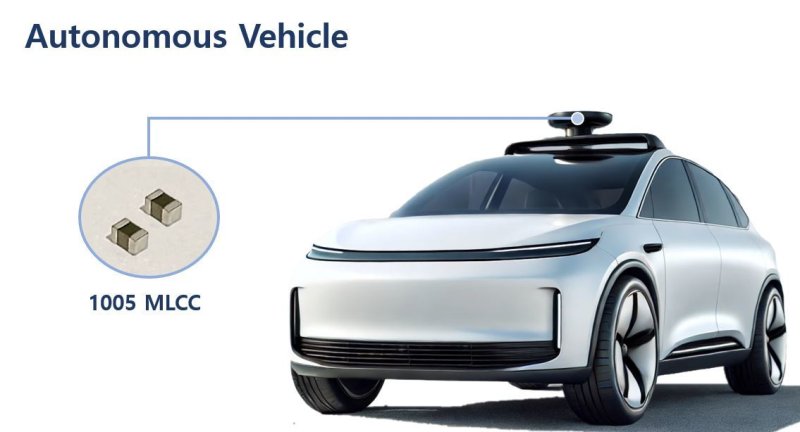

Daishin Securities analyst Park Kang-ho predicted in a Samsung Electro-Mechanics report on the 1st that the company's operating profit for the third and fourth quarters will increase by 11.5% year-on-year to 250.7 billion won, surpassing the consensus (238.7 billion won). Analyst Park reported that Samsung Electro-Mechanics' sales are increasing, focusing on high-value-added products such as multilayer ceramic capacitors (MLCC) and high-performance semiconductor packaging substrates like FC BGA, due to strengthened strategic collaboration with global tech companies. Based on this, he added that the annual operating profit this year is estimated to grow for the second consecutive year, increasing by 18.4% from the previous year to 870.4 billion won.

Analyst Park further stated, "Next year, with the increase in profitability of the MLCC business and the expansion of high-value-added product proportions, operating profit is expected to increase to the level of 1 trillion won (15.9% increase) annually."

Samsung Electro-Mechanics' three core businesses are MLCC, FC BGA, and camera modules. The MLCC market, which is driving overall performance, is positive. The MLCC production operation rate recorded 96% in the first quarter and 98% in the second quarter this year, and it is expected to be 96-98% in the second half. It is virtually a full operation system. Analyst Park predicted that due to the increase in MLCC demand from the electrification of automobiles, a supply shortage may occur next year. Samsung Electro-Mechanics' new business, FC BGA, is also expected to see improved profitability with the expansion of AI and server products.

ehcho@fnnews.com Cho Eun-hyo Reporter