Early Payment of 3 Trillion Won in Earned Income and Child Tax Credit This Year... Average Receipt of 1.08 Million Won

- Input

- 2025-08-28 12:00:00

- Updated

- 2025-08-28 12:00:00

[Financial News] The National Tax Service will make an early payment of the '2024 regular earned income and child tax credit' on August 28, one month ahead of the legal payment deadline (September 30), to stabilize the livelihood of low-income households. The payment targets 2.79 million households that meet income and asset requirements, with a total of 3.0103 trillion won to be paid, averaging 1.08 million won per household.

High Proportion of Single-Person and Young Households... Benefits for Dual-Income Households Expanded

According to the National Tax Service on the 28th, among the regular payment targets this year, 2.08 million households (2.316 trillion won) are eligible for the earned income tax credit, and 710,000 households (694.3 billion won) are eligible for the child tax credit.This results in a total of 4.9 million households receiving 5.4197 trillion won for the 2024 tax credit (regular + semi-annual), a slight decrease compared to the previous year (5.05 million households, 5.5356 trillion won).

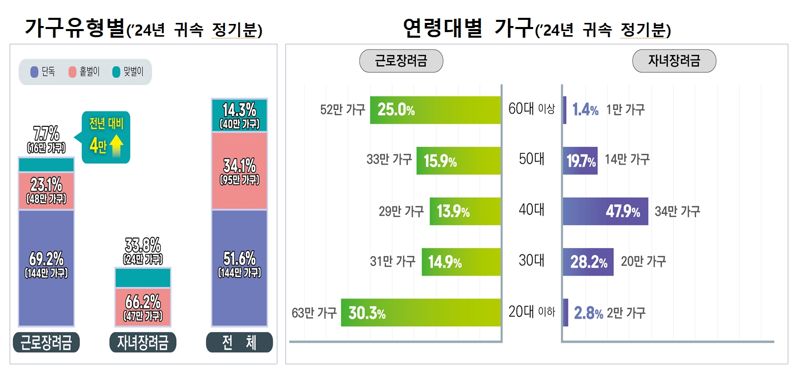

Among the recipients of the regular earned income tax credit this year, 1.44 million households (69.2%) were single-person households.

By age, 630,000 households (30.3%) were under 20s, and 520,000 households (25.0%) were over 60s.

Particularly, the income requirement for dual-income households was relaxed from less than 38 million won to less than 44 million won, resulting in 160,000 households receiving benefits, an increase of 40,000 households compared to the previous year.

The child tax credit was mainly claimed by households in their 40s (340,000 households, 47.9%) and single-earner households (470,000 households, 66.2%), with business income households making up the majority at 2.11 million households (75.7%). Earned income households were 660,000 households (23.6%).

Even if Not Applied, Late Application Possible Until December 1

The tax credit can be received either by account deposit or cash at the post office, depending on the applicant's choice. If cash receipt is desired, it can be collected at the post office with the national tax refund notice and identification.The review results can be checked via mobile, mail, Hometax, or the automatic response system.

Households that have not yet applied can apply late through Hometax or the automatic response system until December 1.

The National Tax Service plans to thoroughly investigate false income documentation and fraudulent claims by high-income earners abusing the tax credit.

If detected, the paid tax credit will be fully recovered, and depending on the severity of the violation, the household may be excluded from receiving the tax credit for up to five years.

A National Tax Service official stated, "We have advanced the payment time to provide practical help to struggling low-income households," and "We will continue to implement inclusive welfare tax policies to support the vulnerable in the future."

imne@fnnews.com Hong Yeji Reporter