Steel Tariff 50% 'As Is'... POSCO and Hyundai Steel Seek Their Own Solutions

- Input

- 2025-08-28 14:19:41

- Updated

- 2025-08-28 14:19:41

Low Impact on U.S. Exports in Short Term

Localization and Resource Independence Strategies to Intensify in Long Term

Localization and Resource Independence Strategies to Intensify in Long Term

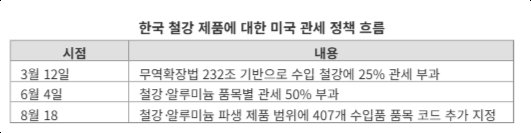

[Financial News] With the failure to reduce the 50% high tariff imposed on Korean steel at the Korea-U.S. summit, the domestic steel industry is preparing individual survival strategies. POSCO Group is focusing on localizing supply chains and expanding overseas steelworks, while Hyundai Steel is accelerating the establishment of electric arc furnace steelworks in North America.

According to the industry on the 28th, POSCO Group's North American export ratio is within 2% of total sales, limiting the impact of tariffs. The annual North American export volume is about 2 to 2.5 million tons, with only 100,000 to 200,000 tons needing to be rerouted to avoid tariffs.

POSCO is working to secure resource independence and establish a local production system to respond to trade barriers. In May, it established the 'Core Resources Research Institute' in Perth, Australia, to begin local research on key minerals for steel and secondary batteries, and in June, it partnered with Anson Resources in Australia to launch a demonstration project for direct lithium extraction (DLE) technology in North America.

In addition, POSCO is considering acquiring the Whyalla Steelworks in Australia to secure low-carbon raw materials such as direct reduced iron (DRI) and hot briquetted iron (HBI). Currently, it imports Australian HBI, but establishing a local production system is expected to reduce logistics costs and secure stable raw materials, enhancing cost competitiveness.

Overseas steelworks expansion is also being intensified. POSCO is pursuing a 6 million-ton integrated steelworks in India and a 2.7 million-ton electric arc furnace steelworks project in the U.S. Including equity investments in Indonesian steelworks, POSCO's overseas crude steel production capacity is expected to expand to 17 million tons by 2035. POSCO's overseas credit ratings are maintained at S&P 'A-' and Moody's 'Baa1', indicating investment-grade status.

Hyundai Steel is also speeding up its localization strategy by establishing an electric arc furnace steelworks in North America. After establishing a local subsidiary in the U.S. in June, it plans to complete the main equipment bidding by the end of this month and select a preferred bidder. To enter the high-value market, it has obtained the Quality System Certification (QSC) for nuclear material supply in the U.S., the first in Korea, and has completed international quality certification for major products such as rebar, sections, and heavy plates.

The industry is paying attention to the possibility of strengthened protectionism in the U.S. following Nippon Steel's acquisition of U.S. Steel. Given Nippon Steel's large-scale local investment plans, there is a forecast that the U.S. government may demand protective measures for its domestic industry. In this case, domestic steel companies with production bases in the U.S. could benefit from rising steel prices in the U.S.

Recently, the steel market is relatively stable due to falling raw material prices. Iron ore has dropped 7% from the previous quarter to $89 per ton, coking coal is down 1% to $184, and scrap steel is down 1% to $337.

Experts advise that as protectionist movements for domestic industries spread globally, the domestic steel industry should prepare more fundamental strategies. Professor Min Dong-jun of Yonsei University's Department of Materials Science and Engineering said, "Not only the U.S. but also Southeast Asia and India are expanding anti-dumping measures under the pretext of protecting their steel industries," emphasizing the need to respond sensitively to changes in export environments to third countries like Southeast Asia as much as to the U.S. market.

Meanwhile, the industry is also looking forward to the 'K-Steel Act (Special Act on Strengthening Steel Industry Competitiveness and Green Transition)' currently being discussed in the National Assembly. The bill includes △the establishment of a special committee directly under the president △designation of green steel special zones △tax and financial support △measures to respond to unfair trade, which is expected to be an opportunity to improve the steel industry's structure. moving@fnnews.com Lee Dong-hyuk Reporter