'Ethereum's Infinite Run' Expectations for Breaking $5000 [CryptoBriefing]

- Input

- 2025-08-25 13:13:19

- Updated

- 2025-08-25 13:13:19

SC "Year-end target price.. adjusted upward from $4000 to $7500"

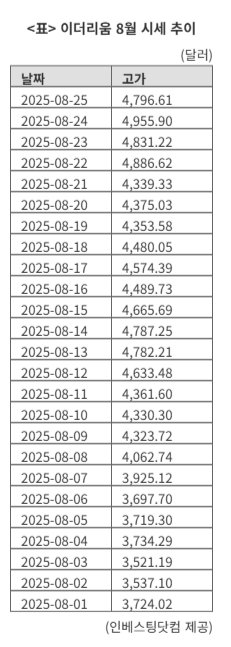

[Financial News] Ethereum (ETH), the second largest cryptocurrency by market capitalization, has reached an all-time high, surpassing the $4900 mark. Having surged nearly 30% this month, Ethereum continues its upward rally, supported by inflows into spot ETFs and companies' 'Ethereum Treasury strategy'.

On the 25th, according to CoinMarketCap, a global cryptocurrency information platform, Ethereum is trading at $4700, down 0.75% from the previous day (24 hours). Ethereum, which reached $4955 overnight, seems to be taking a breather before entering the $5000 mark for the first time.

Ethereum's market cap has exceeded $570 billion. It has surpassed Mastercard's market cap ($540 billion) and ranks 22nd among global assets.

A representative from Xangle Research said, "Ethereum once surpassed $4955, exceeding the previous high of $4878.26 recorded during the COVID-19 pandemic in November 2021," adding, "Ethereum, which has risen more than 40% compared to the beginning of the year, has outpaced Bitcoin's growth rate."

The surge in Ethereum is attributed to the inflow of funds into spot ETFs and the buying spree of companies adopting digital asset treasury (DAT) strategies.

According to Sosovalue, the total net asset value of Ethereum spot ETFs exceeds $30 billion. Among them, 'iShares Ethereum Trust (ETHA)' managed by the world's largest asset manager BlackRock has surpassed $17 billion in assets under management (AUM).

The U.S. Securities and Exchange Commission (SEC) allowing the 'in-kind creation method' for spot-based Ethereum ETFs at the end of July is analyzed to have been a catalyst for institutional fund inflows. The in-kind method is a structure where the ETF issuer issues or redeems ETF shares by directly receiving physical Ethereum from investors without using cash. In other words, physical Ethereum is exchanged instead of cash during the creation and redemption process of the ETF.

Large-scale Ethereum purchases at the corporate level, like those by BitMine and Sharplink, are also acting as a factor for the rise.

Yang Hyun-kyung, a researcher at iM Securities, said, "While the number of companies looking to stockpile Bitcoin as a hedge against inflation is increasing, the trend of companies looking to generate additional revenue through Ethereum staking (deposit rewards) is also on the rise," adding, "BitMine, the largest holder of Ethereum, has formalized its goal of holding 5% of Ethereum's total supply, and Sharplink is also planning to expand its Ethereum holdings to over $2 billion."

Experts predict that with over 150 stablecoins issued on the Ethereum blockchain, coupled with its technical superiority, it is highly likely to break $5000 within the year. Standard Chartered (SC) has also presented a more aggressive outlook. SC has raised its year-end target price for Ethereum from $4000 to $7500 and expects it to reach $25000 by 2028.

However, the 'Ethereum September bear market' based on past data cannot be ruled out. A representative from Xangle Research said, "According to CoinGlass data, in years when Ethereum rose in August since 2016, it recorded a decline in September," adding, "In 2021, for example, it surged 35.6% in August, followed by a 12.5% decline in September." He continued, "We need to keep a close eye on the supply and demand environment, including the inflow of funds into Ethereum spot ETFs, corporate holdings expansion, and interest rate cut expectations."

elikim@fnnews.com Mihee Kim Reporter