Token Securities (STO) Included in National Agenda.. Will It Become a Venture Funding Channel [Crypto Briefing]

- Input

- 2025-08-21 15:42:48

- Updated

- 2025-08-21 15:42:48

[Financial News] With the inclusion of Token Securities (STO) in the national agenda announced by the government, the related institutionalization is expected to accelerate. Token Securities (STO) are financial products that issue physical and financial assets in the form of 'tokens' based on blockchain and are recognized as 'securities' under the Capital Markets Act, allowing them to be traded legally. In particular, the government has identified Token Securities (STO) as a key infrastructure to lead the improvement of the capital market structure, raising expectations in the industry.

According to the National Assembly and related industries on the 21st, the National Planning Committee has included specific details on the institutionalization of Token Securities (STO) in the 'Lee Jae-myung Government's Five-Year National Operation Plan' distributed after completing its official activities.

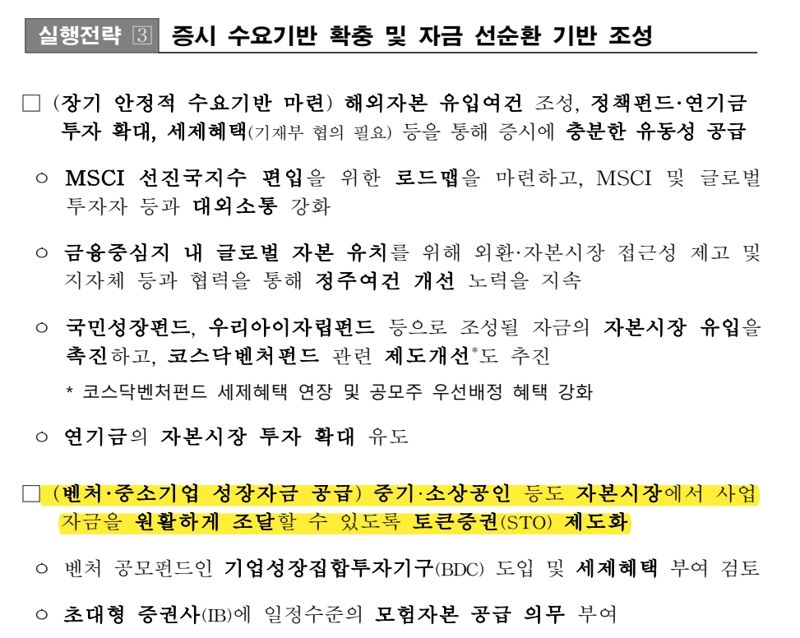

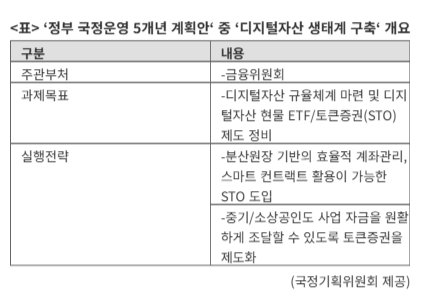

As part of the strategy to promote 'Growth-Boosting Financial Innovation' under the 'Innovation Economy Leading the World,' one of the five national goals, the 'Digital Asset Ecosystem Construction' was presented. The Financial Services Commission is the lead agency.

The government plans to introduce a system for the issuance and distribution of Token Securities (STO) with a focus on the institutionalization of digital asset-related products. The core includes account management based on distributed ledger technology such as blockchain and smart contracts (conditional automatic contract execution).

The government also identified Token Securities (STO) in the section of the 'Realization of Korea Premium to Leap to the KOSPI 5000 Era,' one of the 12 key strategic tasks. The plan is to institutionalize Token Securities (STO) so that SMEs and small business owners can smoothly raise business funds in the capital market.

The industry related to Token Securities (STO) has given significance to the government's redefinition of Token Securities (STO) as a key infrastructure to lead the improvement of the capital market structure. This is because Token Securities (STO), which had been recognized as a means of 'fractional investment' in high-priced assets such as real estate or artworks, is presented as a 'corporate finance tool' to support the fundraising of SMEs and small business owners. By utilizing Token Securities (STO), small business owners can also raise funds by informing general investors about their business and distributing business profits. It is similar to existing IPOs or bond issuance but is innovative in that it is supported by digitalization through blockchain.

Hana Securities, which is preparing a Token Securities (STO) platform, also stated, "Token Securities (STO) can effectively connect small business owners who need business funds with investors," and "The integrated information (DB) of small business owners will be used as basic data to support investors' decisions."

Accordingly, a plan to issue digital securities for intangible assets such as technology patents, content, data, and brand value, which were difficult to evaluate with traditional loans or investment methods, is also expected to be prepared. In particular, if startups and venture companies tokenize their intangible assets, they will be able to attract direct funds from overseas investors as well as venture capital (VC) or bank loans.

Shin Beom-jun, Chairman of the Token Securities Council of the Korea Fintech Industry Association (CEO of BuySellStandard), emphasized, "Token Securities (STO) fundamentally change the accessibility of the capital market as a 'game changer,' providing new opportunities for both small investors and companies," and "Korea has the optimal conditions to become the hub of Token Securities (STO) in Asia once the legislation is completed, given its solid IT infrastructure and financial system."

elikim@fnnews.com Kim Mi-hee Reporter