Seoul Apartment Prices Rise for 29 Consecutive Weeks... The Effect of the 6·27 Measures is 'Wait-and-See'

- Input

- 2025-08-21 14:00:00

- Updated

- 2025-08-21 14:00:00

Rising Trend Since February, 29 Consecutive Weeks of Increase

Slowdown in 18 Districts Including Songpa, Yongsan, Seongdong

"Unstable Upward Trend.. September Supply Measures in Focus"

Slowdown in 18 Districts Including Songpa, Yongsan, Seongdong

"Unstable Upward Trend.. September Supply Measures in Focus"

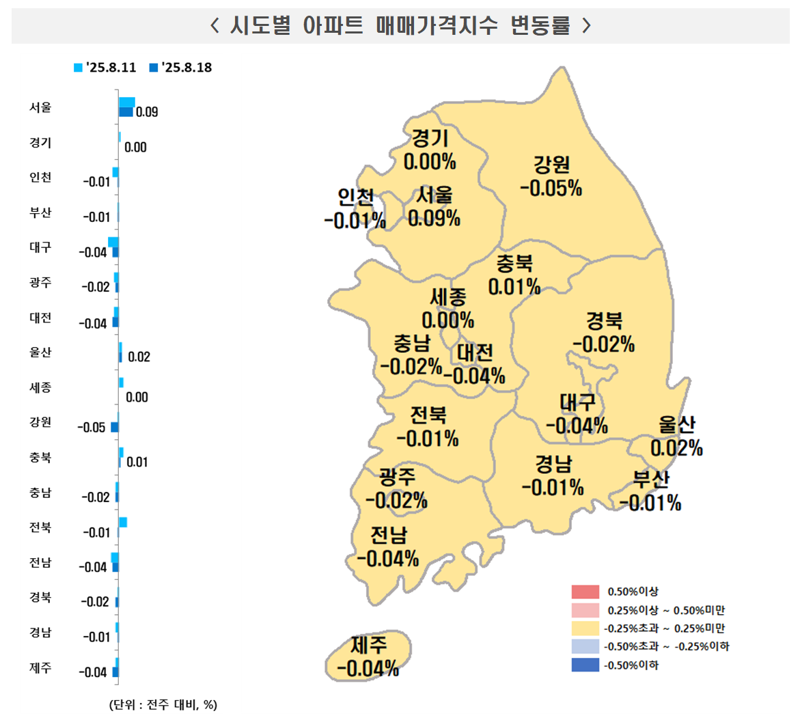

[Financial News] Seoul apartment prices continued to rise for 29 consecutive weeks. Although it has been about two months since the implementation of the 6·27 loan regulation, transactions continue to focus on redevelopment complexes and prime areas, maintaining the upward trend. However, as buyers' wait-and-see attitude deepens, the rate of increase has decreased.

According to the 'Weekly Apartment Price Trend for the 3rd Week of August 2025 (as of the 18th)' announced by the Korea Real Estate Agency on the 21st, Seoul apartment sales prices rose by 0.09%, reducing the rate of increase by 0.01%p compared to the previous week (0.10%).

Seoul apartment prices have been rising for 29 consecutive weeks since turning upward at 0.02% on February 3rd. On June 23rd, just before the regulation, it soared to 0.43%, recording the highest increase rate of the year, but has steadily slowed since July after the implementation of the loan regulation.

By region, the rate of increase decreased in the northeast (0.06%→0.04%), northwest (0.07%→0.04%), southwest (0.09%→0.07%), and southeast (0.19%→0.18%) regions, while only the downtown area (0.08%→0.09%) increased its rate of increase. The trend of slowdown was also observed in 11 districts of Gangnam (0.14%→0.12%) and 14 districts of Gangbuk (0.06%→0.05%).

By district, the rate of increase decreased in 18 districts including Songpa-gu (0.31%→0.29%), the three Gangnam districts, Yongsan-gu (0.13%→0.10%), and Seongdong-gu (0.24%→0.15%). On the other hand, Jung-gu increased its rate of increase from 0.03% to 0.09%, and Jongno-gu also slightly expanded from 0.02% to 0.03%. In addition, five areas including Gangseo-gu (0.07%), Eunpyeong-gu (0.03%), Jungnang-gu (0.02%), Seongbuk-gu (0.02%), and Nowon-gu (0.02%) maintained the previous week's rate of increase.

Mapo-gu rose by 0.06%, decreasing by 0.05%p compared to the previous week (0.11%), showing the largest slowdown. Gwangjin-gu (0.09%) and Yeongdeungpo-gu (0.08%) each fell by 0.04%p, and Yangcheon-gu (0.10%) fell by 0.03%p. Songpa-gu (0.29%), Gangdong-gu (0.10%), and Seodaemun-gu (0.05%) each slowed by 0.02%p, and many areas including Gangnam-gu (0.12%) and Seocho-gu (0.15%) decreased by 0.01%p.

The highest rate of increase was in Songpa-gu (0.29%). It was followed by Seocho and Seongdong-gu (0.15%), Gangnam-gu (0.12%), Yongsan and Yangcheon-gu (0.10%), Gwangjin and Jung-gu (0.09%), Yeongdeungpo-gu (0.08%), and Dongdaemun, Dongjak, and Gwanak-gu (each 0.07%).

The metropolitan area apartment prices rose by 0.03%, reducing the rate of increase compared to the previous week (0.04%). Gyeonggi Province turned flat compared to the previous week (0.01%). Preferred areas such as Gwacheon (0.22%→0.20%) and Seongnam Bundang-gu (0.19%→0.17%) also showed a trend of slowing increase for two consecutive weeks. Incheon fell by 0.01%, reducing the rate of decline compared to the previous week (-0.04%). During the same period, the rent prices maintained the previous week's rate of increase with 0.02% in the metropolitan area and 0.05% in Seoul.

Experts view the rise in Seoul apartment prices as an unstable trend not supported by transaction volume. Park Won-gap, a senior real estate expert at KB Kookmin Bank, said, "Despite the loan regulation, the market continues to show a wait-and-see attitude," and "The future house prices will be greatly influenced by the government's supply measures scheduled to be announced in early September." He added, "If the supply measures are implemented in earnest, the selling trend may increase, leading to a price adjustment."

en1302@fnnews.com Jang In-seo Reporter