Dunamu Holds 10,000 Bitcoins and Ethereum Each [CryptoBriefing]

- Input

- 2025-08-18 13:43:32

- Updated

- 2025-08-18 13:43:32

[Financial News] Dunamu, which operates the won-based virtual asset exchange (Won Market) Upbit, is found to hold more than 10,000 Bitcoins (BTC) and Ethereum (ETH) each. While U.S.-listed companies like Strategy and Bitmain are gaining attention with their so-called 'Digital Asset Treasury (DAT) strategy', domestically, Dunamu's holding of virtual assets worth a total of 2.6 trillion won is drawing attention.

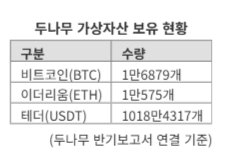

According to Dunamu's semi-annual report on the 18th, as of the end of June, Dunamu's virtual assets held on a consolidated basis amount to △16,879 Bitcoins (BTC) △10,575 Ethereum (ETH) △10,184,317 Tether (USDT), totaling 2.5894 trillion won. Considering that Bitcoin and Ethereum have risen by 8% and 73% respectively since July, the value of Dunamu's virtual assets is estimated to have increased further.

Among the Won Market, Dunamu's virtual asset holdings are overwhelming. In the case of competitor Bithumb, they hold △125 Bitcoins (BTC) △2,305 Ethereum (ETH) △17.75 million Tether (USDT). Including △2.29 million XRP (Ripple) △8.01 million Dogecoin (DOGE) △3.32 million Tron (TRX), the total value is 90 billion won.

There is also analysis that the possibility of Dunamu selling its held Bitcoins and other virtual assets is low. According to the 'Roadmap for Corporate Participation in the Virtual Asset Market' announced by the financial authorities, virtual asset businesses are only allowed to sell for the purpose of covering operating expenses. The authorities have also prepared regulations such as limiting the daily sale limit to within 10% of the total planned sale volume. From the perspective of anti-money laundering, internal control procedures such as board resolutions on virtual asset sale plans and pre-disclosure obligations, as well as post-disclosure obligations on fund usage details, are also regulated.

Dunamu also operates the 'Upbit Staking' service, where investors can entrust their virtual assets to the blockchain network and receive rewards. By directly operating a validator, they lower the entry barrier for individual customers and handle tasks such as hardware costs, operational technology, and security.

An industry official said, “Recently, strategies where companies like Strategy and Bitmain hold large amounts of virtual assets like Bitcoin and Ethereum as corporate assets are gaining attention,” adding, “Domestically, Dunamu is diversifying its portfolio by utilizing the virtual assets accumulated through trading fees while operating Upbit.”

Meanwhile, Dunamu announced that it has attracted 100 corporate clients capable of cashing out virtual assets. Upbit has secured corporate clients representing various fields such as the Prosecutor's Office, Community Chest of Korea, and Coinone, in line with the recent trend of legalization. Upbit is evaluated to have prepared the corporate customer verification (KYC) process and anti-money laundering system early. An Upbit official emphasized, “Based on our technology and operational experience, we will do our best to ensure that corporate clients can participate in the virtual asset investment market stably by complying with regulations and supporting compliance.” elikim@fnnews.com Kim Mi-hee Reporter