K-Battery Overcomes Tariff Barriers by Partnering with Automakers

- Input

- 2025-08-10 15:17:20

- Updated

- 2025-08-10 15:17:20

K-Battery speeds up operation of joint factories in the US with automakers

Reducing market entry costs and maximizing 'lock-in' effect of supply sources

Automakers can speed up battery internalization and supply customized cells

Korea's Big 3 shipbuilders also participate in TF for 'MASGA'... Strengthening cooperation

Reducing market entry costs and maximizing 'lock-in' effect of supply sources

Automakers can speed up battery internalization and supply customized cells

Korea's Big 3 shipbuilders also participate in TF for 'MASGA'... Strengthening cooperation

Expanding 'joint fronts' among companies is becoming a survival strategy to overcome external uncertainties such as economic recession and tariff wars. Domestic battery companies, which have received poor performance reports due to the electric vehicle chasm (temporary demand stagnation) and US tariff measures, have embarked on building joint factories with global automakers. This is to not only expand local production but also flexibly respond to the demand for energy storage systems (ESS), which is emerging as a new source of income in the North American region. The shipbuilding industry has also begun to establish a full-fledged cooperation system, led by the 'MASGA (Make American Shipbuilding Great Again)' project.

■ Battery Big 3 Collaborate with Global Automakers

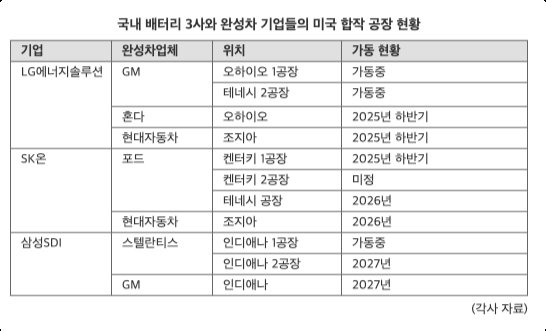

According to the domestic battery Big 3 (LG Energy Solution, SK On, Samsung SDI) on the 10th, they are operating or constructing a total of 11 joint factories in the US with global automakers. The reason battery companies are rushing to partner with automakers is that both sides can achieve a 'win-win strategy'. Automakers can accelerate battery internalization, reduce battery supply costs, and receive customized cells according to various vehicle models. For battery companies, forming alliances with local companies can lower the US market entry barriers raised by tariffs and maximize the 'lock-in effect' of securing stable supply sources. It also allows for flexible changes to the production line of local facilities to respond to the ESS market, which is emerging around the North American region.

A battery industry official said, "There are concerns about a decrease in demand due to the abolition of electric vehicle subsidies in the US, but at the same time, the ESS market due to data center construction can be addressed through local joint factories," adding, "The ability to respond flexibly to the fluid market situation locally is a big advantage."

The most active player is LG Energy Solution. LG Energy Solution is operating joint factories in Ohio and Tennessee with GM (General Motors), one of the US 'Big 3' automakers. Additionally, it is set to operate joint factories in Ohio with Japan's Honda and in Georgia with Hyundai Motor Group. The combined production capacity of the four locations amounts to 169GWh annually.

SK On has partnered with Ford to establish the battery joint venture 'BlueOvalSK', building three joint factories in Kentucky and Tennessee. Once these factories are fully operational, they are expected to have an annual production capacity of 127GWh (gigawatt-hours). The alliance with Hyundai Motor Group is also being strengthened. SK On is already operating two standalone factories (SKBA) in Georgia, supplying batteries to electric vehicles produced at Hyundai Motor Group's Meta Plant America (HMGMA). Additionally, it plans to start full-scale operation by constructing an additional joint factory with Hyundai Motor Group from next year. The production capacity of this factory is expected to exceed the current 22GWh of the two Georgia factories, reaching 35GWh annually.

Samsung SDI has partnered with Stellantis and GM to expand local production capacity. Samsung SDI is operating a joint factory with Stellantis in Indiana, and is constructing a second factory with a target operation date of 2027. A joint factory with GM is also being built in Indiana, aiming for operation in 2027. The production capacity is expected to be 27GWh annually, with potential expansion to 36GWh, according to the company.

■ Korea's Big 3 Shipbuilders Cooperate on US-Korea Shipbuilding 'MASGA'

The shipbuilding industry is also establishing a cooperation system centered on the US. Korea's Big 3 shipbuilders have united for the US-Korea shipbuilding cooperation project 'MASGA'. HD Hyundai, Samsung Heavy Industries, and Hanwha Ocean are participating in the MASGA project task force (TF) to develop a roadmap. The Korea Shipbuilding & Offshore Plant Association is leading the TF, with one executive and one practitioner from each of the three shipbuilders participating.

The summer vacation period for the shipbuilding industry ended last week, and the first MASGA-related meeting is expected to be held as early as this week. The meeting is expected to discuss △step-by-step action plans △scope of technology transfer △possibility of acquiring or establishing shipyards in the US △operation of domestic maintenance, repair, and overhaul (MRO) specialized shipyards.

one1@fnnews.com Jeong Won-il Kim Dong-ho Park Kyung-ho Reporter