83.9% of Korean Manufacturers Say "Main Industries Are Dying Out"... New Businesses "Not Sure"

- Input

- 2025-08-04 12:52:26

- Updated

- 2025-08-04 12:52:26

KCCI Survey on 'Current Status and Challenges of New Business Initiatives'

Targeting 2,186 Manufacturing Companies.. 83.9% "Losing Competitive Edge"

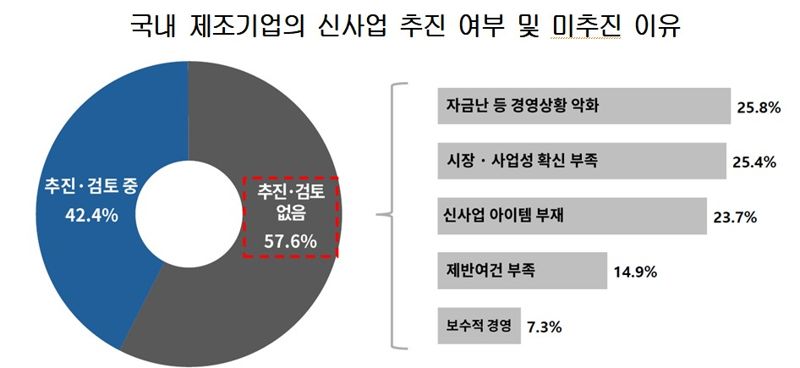

57.6% of Responding Companies "No New Business"... Conservative Management Deepens

Targeting 2,186 Manufacturing Companies.. 83.9% "Losing Competitive Edge"

57.6% of Responding Companies "No New Business"... Conservative Management Deepens

On the 4th, according to a survey conducted by the Korea Chamber of Commerce and Industry on 2,186 manufacturing companies nationwide regarding the 'Current Status and Challenges of New Business Initiatives', 83.9% of companies revealed that they have no competitive edge or have been overtaken in their main industry sectors. Only 16.1% of companies said they are maintaining a competitive edge.

Looking in detail at the responses that they have no competitive edge or have been overtaken, △ 'The technology gap has disappeared, and competition is fierce' 61.3% △ 'Competitors are chasing right up to the chin' 17.1% △ 'Already overtaken in competitiveness' 5.5% were the order.

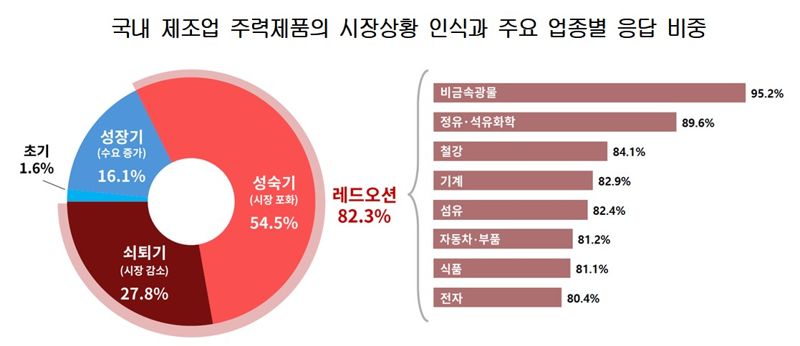

In this survey, 54.5% of responding companies said that their current main products are in the 'maturity stage' of market saturation, and 27.8% of companies said they are in the 'decline stage' of market reduction. Only 16.1% of companies said they are in the 'growth stage', and 1.6% responded that they are in the 'introduction stage', the early stage of market formation.

By industry, non-metallic minerals had the highest proportion of responses indicating maturity and decline stages, followed by refining, petrochemicals, and steel. The responses indicating maturity and decline stages exceeded 80% in industries such as machinery, textiles, automobiles, food, and electronics. The Organization for Economic Cooperation and Development (OECD) predicted that the global steel supply surplus, a representative industry of China's oversupply, would exceed 630 million tons last year (Korea's crude steel production 63 million tons) and surpass 700 million tons by 2027.

The Korea Chamber of Commerce and Industry emphasized that comprehensive support measures for advanced new businesses and main industries should be prepared, and urged the government to introduce direct refunding of investment and tax credit amounts, designate AI investment special zones, prepare patient capital, reintroduce special tax credit for disposal of excess facilities, reduce electricity rates, and expand employment maintenance subsidies. KCCI Team Leader Kim Hyun-soo stressed, "To promote active investment and innovation by companies that are shrinking due to high uncertainty, it is important for the government to share the risk of corporate failure."

Meanwhile, this survey was conducted via email and fax from June 2 to June 13, targeting 2,186 manufacturing companies nationwide. ehcho@fnnews.com Reporter Cho Eun-hyo