Al Square "YBD Records Lowest Vacancy Rate and Highest Rent Increase Rate Simultaneously"

- Input

- 2025-08-04 10:36:16

- Updated

- 2025-08-04 10:36:16

Seoul Office Market in Full Recovery

"Supply Stops, Demand Returns"

First Half Transaction Amount Already Nears 70% of Last Year's Total

"Supply Stops, Demand Returns"

First Half Transaction Amount Already Nears 70% of Last Year's Total

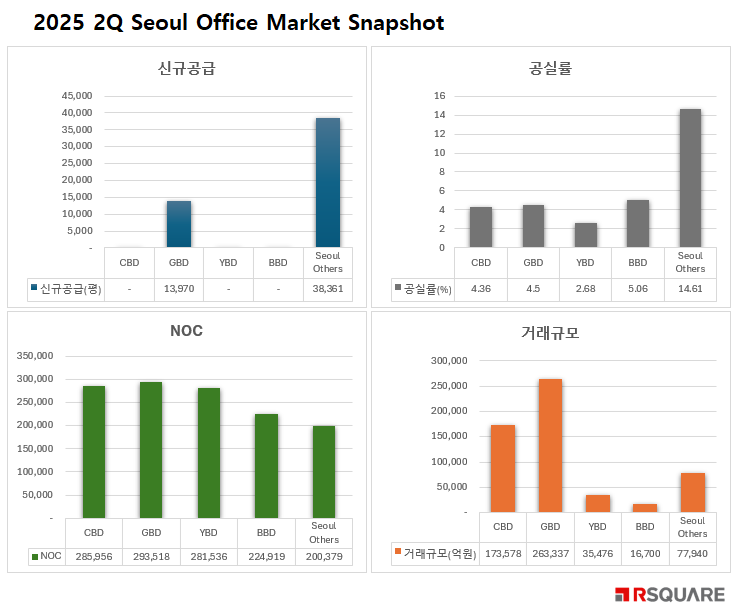

On the 4th, according to the 'Seoul Office, Signal of Selective Recovery' report for the second quarter of 2025 published by the big data department of the comprehensive commercial service company Al Square, the average vacancy rate in major office districts remained stable, and rents steadily increased, focusing on prime assets.

In particular, the recovery of lease demand centered on large offices was prominent in key districts such as Yeouido, Gangnam (GBD), and downtown (CBD).

The recovery trend in the transaction market is also clear. The cumulative transaction amount for the first half has already reached 70% of last year's total, and in some districts, there have been cases of record-breaking prices per 3.3㎡.

Meanwhile, as supply has almost stopped, the recovery of lease demand showed a 'qualitative concentration' trend. In the case of the Yeouido district, it is interpreted as a result of stable demand centered on the financial industry and accelerated movement to prime offices.

In the Gangnam district, the demand for large offices in the IT, tech, and gaming industries was solid. The relocation and expansion of big tech and foreign IT companies, as well as high-growth mid-sized companies, continued, and vacancies in super-large offices were quickly resolved. On the other hand, small and medium-sized assets showed simultaneous rent declines and vacancy accumulation.

The Gwanghwamun and Jung-gu areas in the CBD also saw steady new leases centered on prime assets. On the other hand, in small and medium-sized old assets, vacancy increases due to reconstruction and relocation were confirmed.

Jin Wonchang, head of the big data department, said, "The investment recovery in the Seoul office market in 2025 is significant not just as a recovery of transaction volume, but as a recovery of trust in the market," adding, "The diversification of buyers and selective concentration of assets rather show the strength of the market."

In the second half, the 'response strategy for small and medium-sized assets' is expected to be crucial. Jin said, "Without active responses such as asset upgrades, fit-out strategies, conversion to shared offices, and rebranding, long-term vacancies and value declines may occur simultaneously," predicting that "ultimately, the strategic capabilities of asset owners will be the key factors distinguishing profitability and vacancy rates."

ming@fnnews.com Jeon Mingyeong Reporter