Samsung Securities 'Stablecoin Top Pick'.. Kakao Pay·NHN KCP [Crypto Briefing]

- Input

- 2025-08-01 18:10:03

- Updated

- 2025-08-01 18:10:03

High potential for revenue generation through stablecoin issuance and distribution

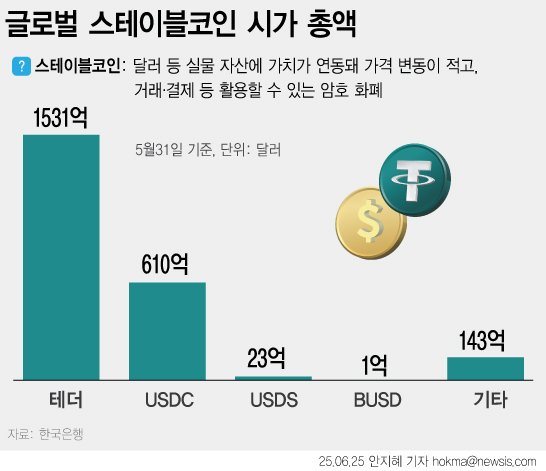

[Financial News] Samsung Securities has identified Kakao Pay and NHN KCP as the 'Top Pick for Korean Won Stablecoin' and raised their target prices. This decision is based on the assessment that large fintech companies like Kakao Pay would have a relative advantage if stablecoin issuance by fintech (non-banking) is ultimately permitted during the domestic stablecoin legislation process. Additionally, the potential for revenue generation through stablecoin distribution was highly evaluated.

Samsung Securities researcher Park Jun-kyu stated, “We are adjusting the target prices of Kakao Pay and NHN KCP to 79,000 KRW and 22,000 KRW, respectively, which is an increase of 23.4% and 24.8% from the previous targets,” on the 1st. While related stocks have surged as investment sentiment has concentrated on the stablecoin theme, selective approaches are necessary for companies with ecosystem preemption capabilities.

Researcher Park said, “We are adjusting the annual operating profit forecasts and target prices of payment companies to reflect the expected recovery in consumption in the second half of the year and the anticipation related to stablecoins,” and added, “Among payment companies, those with high relevance to stablecoins are expected to be Kakao Pay and NHN KCP.”

The reason Samsung Securities selected Kakao Pay as the top pick is due to its overwhelming advantage in ecosystem construction. As of the second quarter, Kakao Pay's prepaid balance is 591.1 billion KRW, significantly ahead of competitors like Naver Pay (161.7 billion KRW) and Toss (134.4 billion KRW).

The potential collaboration with Kakao Bank, which holds a banking license within the Kakao ecosystem, is also a point of interest. If strict regulations are applied to stablecoin issuers domestically, similar to the U.S. stablecoin bill (Genius Act), it is speculated that Kakao Bank could be utilized. However, there is also a view that decision-making may not be easy given that Kakao holds only 46.3% and 27.2% stakes in Kakao Pay and Kakao Bank, respectively.

NHN KCP's competitiveness in the payment infrastructure market, rather than stablecoin issuance, is highlighted. As the number one online payment operator in Korea, it has a network of hundreds of thousands of merchants. Thus, if stablecoins gain attention in overseas remittances and payments, it could enjoy a first-mover advantage.

However, Samsung Securities cautioned against excessive optimism regarding stablecoin-related stocks. Researcher Park warned, “It is difficult to generate market-expected performance solely through stablecoin issuance, and significant costs may be incurred for activation,” and explained, “The key is differentiated revenue generation capabilities through ecosystem enhancement.” He added, “Rather than a simple theme stock approach, selective investment in companies with substantial competitiveness is important.”

elikim@fnnews.com Kim Mi-hee Reporter