December Settlement Corporations, Corporate Tax Prepayment by September 1st... 2-Month Payment Deferral for Companies Affected by Heavy Rain

- Input

- 2025-08-01 12:00:00

- Updated

- 2025-08-01 12:00:00

[Financial News] The National Tax Service announced on the 1st that December settlement corporations must report and pay the interim corporate tax for the first half of 2025 by September 1st. The subjects of payment are a total of 528,000 corporations, including profit-making domestic corporations, non-profit corporations conducting profit-making businesses, and foreign corporations with domestic business sites, an increase of about 11,000 compared to last year.

From this year, approximately 2,600 corporations belonging to the public disclosure target corporate group must calculate the interim tax amount using the provisional settlement method. However, small and medium-sized enterprises among them are exceptions.

General corporations can choose between two methods. △ Pay 50% of the calculated tax amount from the previous business year or △ pay based on the provisional settlement for the first half of this year. Small and medium-sized enterprises with a tax amount less than 500,000 won in the previous business year are exempt from the interim payment obligation.

The National Tax Service is also providing a convenient reporting system through Hometax and Sontax apps from August 1st. By using the 'Pre-fill Service' and 'Interim Tax Amount Inquiry Service' where the automatically calculated tax amount based on the previous year is entered, it is easy to report and pay.

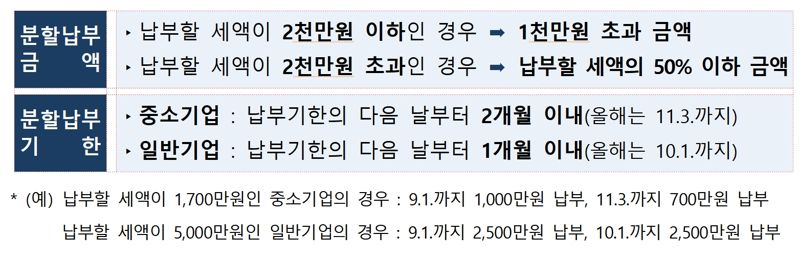

If the tax amount exceeds 10 million won, installment payment is also possible.

The National Tax Service has decided to extend the payment deadline by two months without separate application for about 38,000 corporations, including small and medium-sized enterprises designated as special disaster areas due to heavy rain, wildfires, and aircraft accidents, as well as export small and medium-sized enterprises with decreased sales, and small and medium-sized enterprises in the petrochemical, steel, and construction industries.

These companies can pay by November 3rd, not the original payment deadline of September 1st. Companies that choose installment payment will also have their payment deadline extended by an additional two months.

The total interim tax amount for this tax support target is calculated at 808.4 billion won. This is an increase of about 184 billion won compared to the previous year. Among them, petrochemical, steel, and construction corporations account for more than 50% of the total tax amount. Support for export companies has also been expanded, with 187 additional medium-sized enterprises included in addition to the existing 4,055 small enterprises.

A National Tax Service official said, “We hope that companies struggling with natural disasters and domestic market stagnation can reduce their burden through tax support,” and added, “In addition, if a corporation experiencing significant business losses applies for an extension of the payment deadline, we will actively review and accommodate as much as possible.”

imne@fnnews.com Hong Yeji Reporter