"Catch SK Hynix and Micron"... Samsung Electronics, Starting to Reverse the Atmosphere

- Input

- 2025-07-31 16:53:58

- Updated

- 2025-07-31 16:53:58

Samsung Electronics, Shipping 6th Generation HBM4 Samples

Featuring 10nm-class 6th Generation (D1c)

HBM4 Expected to Boom in 2026

Reversing Atmosphere with Taylor Operation and M&A

Featuring 10nm-class 6th Generation (D1c)

HBM4 Expected to Boom in 2026

Reversing Atmosphere with Taylor Operation and M&A

Third Shipment After SK Hynix and Micron

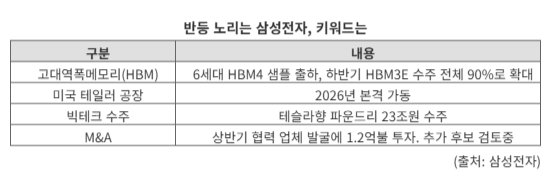

Samsung Electronics is the third semiconductor company to ship HBM4 samples after SK Hynix and Micron.Previously, SK Hynix sent the industry's first HBM4 12-layer samples to customers in March this year and is planning mass production in the second half of the year while simultaneously developing 16 layers. Micron completed the shipment of 12-layer samples of the same generation in early June. HBM4 is the next product after HBM3E, a next-generation ultra-high-performance memory that has significantly advanced existing technology.

Although a step behind, Samsung Electronics has chosen "next-generation DRAM" as its weapon. Unlike SK Hynix and Micron, which are incorporating 10nm-class 5th generation (D1b) into HBM4, Samsung Electronics is applying a more advanced 10nm-class 6th generation (D1c) product. D1c is known to have higher power efficiency and manufacturing difficulty compared to D1b. The evaluation that Samsung Electronics can lead in technology among the three companies is not unrelated to this.

In this regard, Jaejun Kim, Vice President of Samsung Electronics Memory, said, "We have completed the approval for mass production transition of the 10nm-class DRAM 1c process."

Global companies expect the demand for HBM4 to explode in 2026. Although it is known to be about 30% more expensive than the previous generation, the number of companies looking for high-efficiency, low-power semiconductors, such as AI servers, is rapidly increasing.

Samsung Electronics plans to regain its lost competitiveness starting with HBM4. The industry sees a high possibility of reversing the atmosphere as the judicial risks that have been holding back Chairman Jae-yong Lee for over 10 years have been resolved, and a large foundry order worth nearly 23 trillion won was recently secured from the U.S. automaker Tesla.

"Warming Up Finished"... U.S. Plant Operation and M&A Awaiting

Samsung Electronics plans to further strengthen its competitiveness by operating the Taylor plant in the U.S. next year and actively considering M&A. Nomi Jeong, Executive Director of Samsung Electronics Foundry Division, said, "Samsung Electronics has been promoting the construction of a new Taylor plant to secure advanced semiconductor orders from various customers in the U.S.," and "The investment in the Taylor plant this year is scheduled to be executed within the 2025 facility investment plan, but the scale will increase next year."

Beyond the overall growth of the semiconductor sector, including memory and non-memory, the company plans to focus on securing future growth drivers. Samsung Electronics announced three major acquisitions this year alone. In May, it acquired the German HVAC company FlaktGroup for 1.5 billion euros (approximately 2.38 trillion won), and earlier in the same month, it acquired the U.S. Masimo's audio division for 350 million dollars (approximately 480 billion won) through its subsidiary Harman. Earlier this month, it announced an acquisition agreement with the U.S. digital healthcare company Zelus. The amount is known to be in the thousands of billions of won.

Park Soon-chul, Chief Financial Officer (CFO) of Samsung Electronics, said, "In the first half of this year, we invested more than 120 million dollars (approximately 170 billion won) in about 40 companies, focusing on AI, robotics, digital health, etc., not only for M&A but also for future technology new business sensing. This is the largest scale in Samsung Electronics' history for a half-year period," and emphasized, "We are broadly looking at candidate companies in new growth areas such as AI, HVAC, meditech, and robotics. We will share (with the market) as soon as it becomes more visible."

kjh0109@fnnews.com Kwon Joon-ho, Lim Soo-bin Reporter