LH, Recruiting AMC for 'PF Modernization Priming Water Development Anchor REITs' with a Scale of 800 Billion Won

- Input

- 2025-07-31 14:00:33

- Updated

- 2025-07-31 14:00:33

Select and invest in excellent business sites at the bridge loan stage

[Financial News] Korea Land and Housing Corporation (LH) announced on the 31st that it is recruiting AMC (Asset Management Company) to participate in the 'PF Modernization Priming Water Development Anchor REITs Project'.

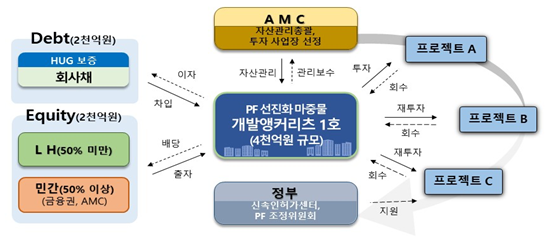

This project involves the Development Anchor REITs, funded by LH and the private sector, selecting and investing in excellent business sites at the bridge loan (short-term loan before construction) stage, and then recovering funds upon the execution of the main PF. It was prepared to support the stability of the real estate development market and the activation of the construction economy by public pre-investment in excellent business sites experiencing difficulties in raising initial business funds.

The Development Anchor REITs is expected to be established with a scale of about 800 billion won (more than 2 REITs), with LH investing 200 billion won, along with private investments and Housing & Urban Guarantee Corporation (HUG) guaranteed corporate bond borrowings. The investment amount is up to 100 billion won per business site (within 50% of land purchase cost), and the investment is recovered upon conversion to the main PF.

The investment targets are business sites that meet the criteria presented by the Ministry of Land, Infrastructure and Transport and LH, such as △business feasibility △land acquisition status △permit possibility △capital stability, and are finally selected through the REITs' own investment review committee, etc. In addition to business stability, projects used as national growth engines such as (rental) housing supply and AI data centers will be prioritized, and cases where local governments or local public corporations participate or wish to invest will also be reflected in the preferential conditions.

The AMC recruitment starts with the announcement today and will accept applications until September 30th. After that, the preferred negotiation target will be selected through screening and evaluation in October and November. The selected AMC will be responsible for the overall operation of the REITs, including investor recruitment, investment site discovery, investment review committee operation, fund execution, and management.

The applicant company must meet the criteria such as △operating real estate development collective investment (REITs·funds) of 100 billion won or more with real estate investment company operation qualifications under the Real Estate Investment Company Act △participation of two or more key management personnel △criteria for securing investors.

In addition, they must propose the total amount of investment commitments through attracting private investors (exceeding 50% of the total investment commitment), and propose an operation strategy and investment plan considering the characteristics of the funds and the REITs business goals. Also, at least one business site that meets the investment target selection criteria must be presented when applying for the recruitment.

en1302@fnnews.com Jang In-seo Reporter