[fn Editorial] Consider carefully why only the Korean economy is viewed negatively

- Input

- 2025-07-30 18:37:59

- Updated

- 2025-07-30 18:37:59

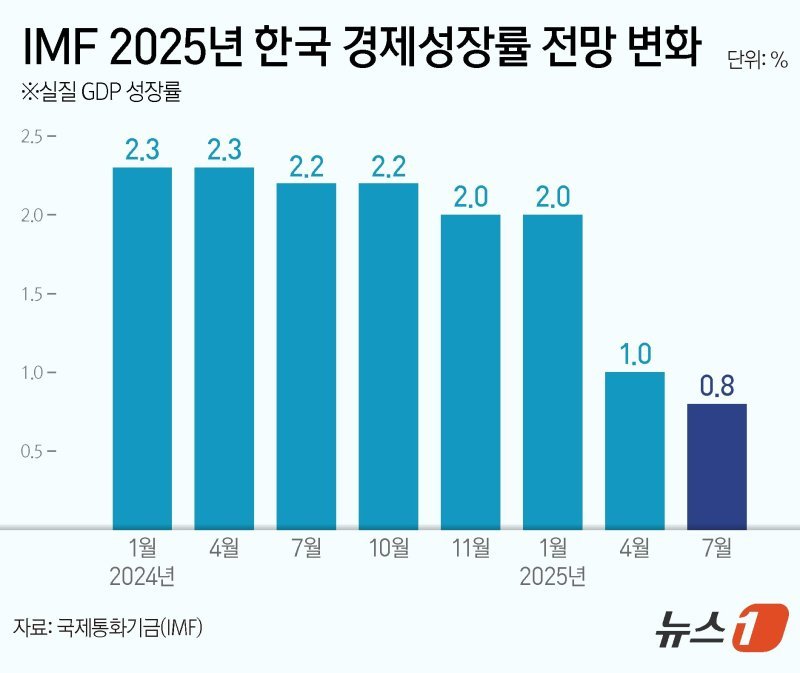

IMF lowers Korea's growth rate to 0.8% this year

Reconsider anti-business legislation like the Yellow Envelope Act

Reconsider anti-business legislation like the Yellow Envelope Act

There is some expectation for domestic demand recovery in the second half due to supplementary budgets and consumption coupons. However, there are limits to how far the warmth can spread. The IMF predicted a rebound in Korea's growth rate to 1.8% next year, assuming that consumer and investment sentiment improves after the second half. However, this is a limited forecast based on the assumption that U.S. tariffs remain unchanged. It is uncertain whether the Korean negotiation team can succeed in reaching a mutual tariff agreement of 15% like Japan and the European Union (EU). Even if a sudden agreement is reached, the 15% mutual tariff and subsequent item-specific tariffs would be a significant burden on Korean companies. Next year's growth is already showing warning signs.

The IMF lowered the growth forecast for only three countries out of 30: Russia, which is at war with Ukraine, the Netherlands, which has a high export ratio of pharmaceuticals and various goods to the U.S., and Korea. While raising the global growth forecast to 3.0%, the IMF increased the U.S. forecast to 1.9% and China's to 4.8%. The EU and Japan were also raised from previous forecasts. Among countries with similar industrial competitiveness, Korea is the only one with a lowered forecast.

We must carefully examine the reasons why our economy is uniquely struggling against the global economic trend. External factors such as the tariff war and global oversupply, along with the prolonged domestic demand slump, are hindering growth. Additionally, we must recognize and improve our unique issues, such as low productivity, a rigid labor market, and strong unions.

The Yellow Envelope Act (amendments to Labor Union Act Articles 2 and 3), which blocks demands for compensation for illegal strikes, will be an additional adverse factor. Major industries supporting our economy, such as automobiles, shipbuilding, and construction, could suffer significant damage. The re-increase of corporate taxes and mandatory share buyback clauses are also problematic.

Faced with rising protectionism, companies are moving their factories overseas. Illegal strikes by unions may also be a cause. The foundation for domestic industrial growth is likely to shrink further. Therefore, the government and political circles need to find new growth engines with extraordinary determination and support businesses, but policies are going in the opposite direction, which is frustrating.

President Lee Jae-myung promised on the 30th to actively support corporate activities by preventing the abuse of breach of trust charges. To this end, he announced the immediate operation of the Economic Penalty Rationalization Task Force (TF) and the promotion of extensive regulatory innovation. Easing breach of trust charges and regulatory reform are natural policies for corporate support. Before that, we must carefully consider whether policies that strangle businesses, such as the Yellow Envelope Act and tax increase policies, are appropriate.