[fn Editorial] Will anti-business policies drive away even foreign capital?

- Input

- 2025-07-29 18:25:25

- Updated

- 2025-07-29 18:25:25

Corporate tax rate increase threatens corporate survival

Trust declines with the forced passage of the Yellow Envelope Act

Trust declines with the forced passage of the Yellow Envelope Act

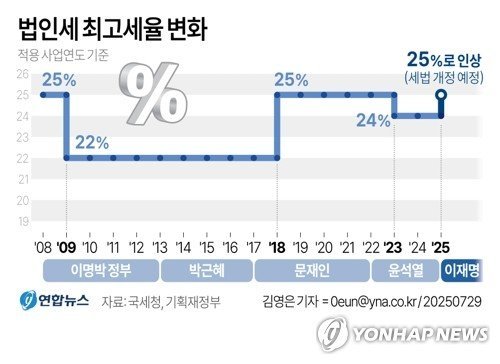

The government plans to restore the tax rate that the Yoon Suk-yeol administration lowered from 25% to 24% in 2022. The corporate tax rate can be sufficiently discussed in terms of realizing tax justice, which means paying as much as you earn. However, the current increase in the corporate tax rate is being enforced as an instrumental means for fiscal expansion. It is an attempt to cover the tax revenue shortfall by increasing the corporate tax rate. In that case, the government's decision to increase the corporate tax rate is a misreading of the timing. Raising the corporate tax rate in a situation where economic prospects are uncertain due to changes in U.S. tariff policies is inappropriate. Moreover, it cannot be concluded that the tax revenue shortfall is due to the reduction in the corporate tax rate. Anyway, if a company falls into a business slump, it will not even have the capacity to pay taxes. Therefore, it is right to support companies to overcome difficult conditions and make more profits. It is not too late to carefully judge after overcoming the tariff crisis if you want to increase the corporate tax rate. Yet, it is incomprehensible why the corporate tax rate increase is being rushed so much.

The more serious issue is the Yellow Envelope Act. This law passed the plenary session of the National Assembly's Environment and Labor Committee. The core of the law is to expand the scope of users to strengthen the responsibility of the primary contractor for subcontracted workers and to limit the scope of compensation for damages against unions or workers. It is already known that domestic companies and economic organizations are opposing it. However, this time, the European Chamber of Commerce in Korea warned that if this bill is implemented, it may withdraw from the Korean market. The concern is that the passage of the Yellow Envelope Act may not only affect domestic companies but also encourage the withdrawal of foreign capital that has entered the country. In fact, foreign companies operating in Korea cite labor market rigidity and labor-management conflict as the number one management instability factor. If the Yellow Envelope Act is implemented on top of that, there is no reason to stay in Korea anymore. Currently, domestic companies are increasing direct investment in overseas markets. There are pros and cons to domestic capital's overseas investment. The problem is that the reduction in domestic jobs and production facilities has a significant impact on the domestic economy. Therefore, it is important to increase foreign direct investment in the country at this point. In this situation, should we push foreign capital that has entered the country out by enforcing the Yellow Envelope Act? It is tantamount to tying the economy's feet.

The Korean economy is facing internal and external challenges. There are complex factors such as U.S. tariff policies, intensified competition with China, and domestic consumption slowdown. In such a difficult situation, policies that impose additional burdens on companies only dampen the vitality of the entire economy.

In such times, the government and the National Assembly should strive to make the country a good place to do business. The increase in the corporate tax rate and the Yellow Envelope Act are contrary to such policy directions. Increasing tax burdens and strengthening regulations are like shackling the feet of companies. It is a critical time to create an environment where companies can increase investment and create jobs. The Lee Jae-myung government and the ruling party should reconsider their policy direction even now.