Kim Hong-guk's Bet Paid Off... Pan Ocean's Performance Doubled in 10 Years

- Input

- 2025-07-28 15:35:07

- Updated

- 2025-07-28 15:35:07

Harim Group, 10 years since acquiring Pan Ocean.. Sales and operating profit 'double'

Fleet expanded to about 290 ships.. Full-scale entry into the crude oil market with VLCC acquisition

Grain sales reach 1 trillion won, entering major global traders

Fleet expanded to about 290 ships.. Full-scale entry into the crude oil market with VLCC acquisition

Grain sales reach 1 trillion won, entering major global traders

[Financial News] Pan Ocean has transformed into a 'swan' by doubling its sales and operating profit 10 years after joining Harim Group. Once under court management, Kim Hong-guk, chairman of Harim Group, made a 'divine move' by betting that the BDI (Baltic Dry Index) couldn't go any lower. Particularly, Chairman Kim guaranteed autonomous management, leading to a market capitalization surge of over 1200%. The industry evaluates that the diversification of the business structure, which was previously focused on dry bulk, and synergy with Harim led to successful structural improvement.

■Profit generation through diversification of shipping business structure

According to the industry on the 28th, Pan Ocean will mark 10 years since being acquired by Harim Group on the 30th. Harim Group acquired a 52% stake in Pan Ocean in collaboration with JKL Partners in 2015, investing 1.08 trillion won.

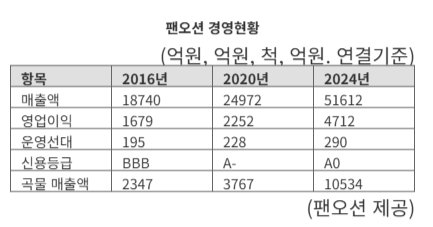

Since joining Harim Group, Pan Ocean has increased its fleet from less than 200 ships to about 290 ships. This has laid the foundation for more than doubling both sales (5.1612 trillion won) and operating profit (471.2 billion won) by the end of 2024 compared to the end of 2016. Considering that the operating profit in 2015 was around 185 billion won, the growth rate is steep.

The main fleet, which was focused on dry bulk (grains, coal, minerals, etc.), secured additional long-term freight contracts. Pan Ocean derives 40% of its sales and 68-70% of its operating profit from long-term contracts. This has established a system for generating stable profits despite market volatility.

Recently, the company has been actively expanding its business structure, which was focused on dry bulk, into other areas within shipping. The LNG transportation business unit, which had only one LNG carrier (LNGC), has significantly expanded by investing in an additional 10 LNGCs and 2 LNG bunkering vessels (LNGBVs) through contracts with major global shippers.

By investing in two ultra-large crude oil carriers (VLCCs), the company has signed contracts with major domestic and international shippers. Recently, it has further expanded its WET BULK (crude oil, product oil, animal and vegetable oil) business by ordering an additional two VLCCs (contracted with HD Hyundai Heavy Industries for 300,000 DWT class).

■Synergy with Harim in 'grain trading'

In the grain trading sector, based on Pan Ocean's unique logistics network, grain sales in 2024 are expected to reach 3.12 million tons, with sales amounting to 1 trillion won. It is evaluated that the company has realized the effect of stable supply of livestock and feed raw materials for Harim Group. The 'local operation' secured at overseas grain terminals (EGT in the US) and the strengthened sales network in Asia (Korea, China, Southeast Asia) seem to have brought Chairman Kim closer to his goal of protecting 'Korea's grain food security'. The company plans to strengthen its position in the grain business by actively entering the Southeast Asian market in the future.

After joining Harim Group, Pan Ocean's market capitalization surged from 156.8 billion won to 2.1295 trillion won, an increase of 1257.6%. After the acquisition, the credit rating rose two notches from BBB to A0. The net debt level is virtually 'zero (0)', and the company has sufficient cash assets. The consolidated debt ratio reached 1925% in June 2013. The current debt ratio is 66% in 2020, 80.4% in 2021, 68% in 2022, 66.6% in 2023, and 81.7% in 2024, boasting a sound financial status.

Pan Ocean also introduced to the market a plan for capital expenditure (CAPEX) to invest in LNG ships and other Non-Dry (excluding bulk carriers) over the next three years, amounting to approximately 1.02 billion dollars in the latter half of 2025, about 300 million dollars in 2026, totaling approximately 1.13 billion dollars (about 1.6 trillion won) over three years, including about 100 million dollars in 2027.

An industry official said, "Pan Ocean has succeeded in innovating its structure and profit model based on synergy with Harim despite external uncertainties such as the global economic downturn, market volatility, and oversupply," adding, "It is taking steps to transform from a simple shipping company into 'Korea's representative comprehensive grain and shipping company'." ggg@fnnews.com Kang Gu-gwi Reporter