"Unable to Move and Blocked from Switching to Low-Interest Loans" Side Effects Emerge [6·27 Regulation One Month]

- Input

- 2025-07-24 18:27:15

- Updated

- 2025-07-24 18:27:15

Regulations on Basic Moving Expenses Prevent Home Purchase

Funding Issues for Members Preparing to Move

Restrictions on Loan Refinancing Excluded from Total Loan Amount

Experts "Need for Exceptional Application of Loan Regulations"

Funding Issues for Members Preparing to Move

Restrictions on Loan Refinancing Excluded from Total Loan Amount

Experts "Need for Exceptional Application of Loan Regulations"

According to the industry on the 24th, there are calls for improvement, stating that some unreasonable loan regulations are even hindering the housing stability of real demanders.

First is the regulation on moving expense loans. When the government announced the '6·27 Measures', it included basic moving expenses in the regulation target. On the other hand, additional moving expenses are planned not to be regulated. Basic moving expense loans are granted on the condition that no additional housing is purchased. In contrast, additional moving expense loans can be used for housing purchases. For members wishing to move, while residence relocation is restricted, the path to purchase another house with additional moving expenses is open.

An industry official pointed out, "The regulation on moving expenses itself is problematic, but regulating basic moving expenses that do not allow home purchases does not align with the purpose of the regulation."

Concerns are growing that the regulation on moving expense loans could disrupt housing supply. In the case of '1+1 sales', it is classified as a multi-homeowner with two houses, blocking loans. In the case of Noryangjin District 1, more than half of the members who applied for sales have applied for 1+1 sales.

That's not all. Loan regulations apply uniformly throughout the metropolitan area. Even areas with declining populations in the metropolitan area are affected. Professor Ko Jun-seok of Yonsei University's Sangnam Business School said, "These areas are experiencing a decrease in housing demand, and the recent measures have made it more difficult."

It has also become more difficult for ordinary people to own a home. With the reduction of policy loans, considering the asset standard (488 million won) and loan limit (400 million won), only houses below 888 million won can be purchased. Most Seoul apartments are effectively excluded from the purchase target.

'Switching (refinancing)' is also prohibited, exacerbating confusion on the ground. When transferring a mortgage loan to another bank, the loan limit is restricted to 100 million won. The average balance of borrowers who received mortgage loans from banks is around 150 million won, effectively blocking refinancing from other banks.

Among real demanders, there is a flood of complaints that consumer choice is being blocked. Inter-bank refinancing is switching an existing loan to another bank, which does not affect the total loan amount, yet it has been excessively regulated.

For example, a borrower who received a hybrid mortgage loan during the ultra-low interest period 4-5 years ago, which applied a 5-year fixed rate and then switched to a variable rate, was at a 2% interest rate at the time, but now it has risen to 4-5%. Even if there is a better product at another bank, they cannot switch. Switching to another mortgage product within the same bank is possible, but in this case, the contract can be made with a 30-year maturity condition, increasing the interest burden on real demanders.

A senior industry official said, "Instead of a uniform 600 million won limit, loans should be regulated based on housing prices, and in the case of moving expense loans, the condition of prohibiting additional housing purchases should be applied," adding, "In the case of inter-bank refinancing, exceptions should be made in loan regulations, and fine-tuning is necessary."

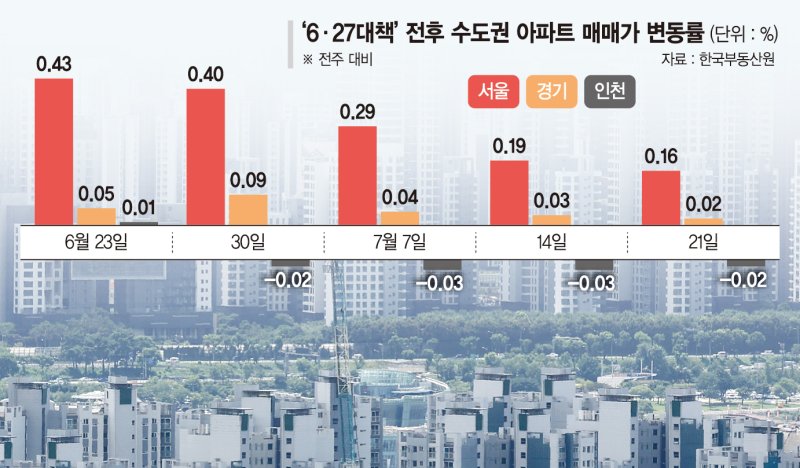

Meanwhile, according to the 'Weekly Apartment Price Trend' announced by the Korea Real Estate Agency on this day, the sale price of Seoul apartments rose by 0.16%, reducing the increase by 0.03%p compared to the previous week (0.19%). The impact of the 6·27 real estate measures continues, showing a slowdown in the rise of Seoul apartment sale prices for the fourth consecutive week.

act@fnnews.com Choi Ah-young Lee Jong-bae Reporter