U.S. Tariff 'Windfall' for SK Hynix, Achieves Record Performance

- Input

- 2025-07-24 16:01:43

- Updated

- 2025-07-24 16:01:43

Pre-purchase effect before U.S. tariff imposition

D-RAM, NAND flash shipment surge

"Supply and demand maintained by AI demand in the second half"

Investment expansion, securing competitiveness through mass production

D-RAM, NAND flash shipment surge

"Supply and demand maintained by AI demand in the second half"

Investment expansion, securing competitiveness through mass production

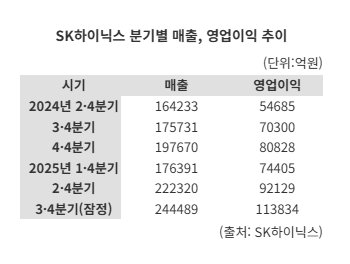

SK Hynix announced on the 24th that its operating profit for the second quarter of this year increased by 68.5% year-on-year to 9.2129 trillion won. During the same period, sales increased by 35% to 22.232 trillion won. This is a quarterly performance surpassing the previous record set in the fourth quarter of last year. Global big tech companies have been actively investing in AI, steadily increasing demand for AI memory, and both D-RAM and NAND flash recorded shipment volumes exceeding expectations, achieving the highest performance ever, according to SK Hynix.

In particular, the movement of customers to stockpile products just before the imposition of U.S. tariffs had a significant impact.

Kyu-Hyun Kim, in charge of D-RAM marketing at SK Hynix, explained, "Customers intended to maintain a conservative inventory level in the first half of this year, but as uncertainty regarding tariff policy increased, they shifted to a strategy of securing an appropriate inventory level," adding, "This is the reason why the increase in product shipments in the second quarter significantly exceeded the initial guidance." In fact, the D-RAM sales proportion in the second quarter of this year was 77% of the total, an 11 percentage point increase from 66% in the same period last year.

NAND flash also benefited significantly from the tariff effect. Seok Kim, in charge of NAND flash marketing, said, "In the last quarter's earnings announcement, we presented a guidance of over 20% increase in NAND shipments for the second quarter, but the demand for enterprise solid-state drives (eSSD) increased due to the expansion of AI investments by hyperscale companies (places that utilize large-scale data center infrastructure to process vast amounts of data and provide services)," and "pull-in demand centered on single items due to the tariff impact was added." SK Hynix's NAND flash shipments in this quarter increased by more than 70% compared to the previous quarter.

SK Hynix expects the market supply and demand for both products to be maintained in the second half.

Kyu-Hyun Kim stated, "Although concerns about demand slowdown in the second half persist, system builds are also increasing, so customers' inventory levels have not risen to a significantly worrying level," and "the inventory of memory suppliers has also decreased considerably, so only supply increases due to production increases will be possible in the future."

SK Hynix plans to continue strong demand by purchasing HBM production equipment through expanded investment and operating Cheongju M15X.

Hyun-Jong Song, President of SK Hynix Corporate Center, said, "M15X will open in the fourth quarter of this year and contribute to full-scale mass production next year," and "We plan to gradually increase production capacity related to next-generation HBM."

kjh0109@fnnews.com Jun-Ho Kwon Reporter