Manufacturing Sentiment Drops the Most in 7 Months... "Prolonged Tariff Uncertainty"

- Input

- 2025-07-24 06:00:00

- Updated

- 2025-07-24 06:00:00

Bank of Korea Announces July 2025 Business Survey Results

Down 0.2p from the previous month to 90.0... Decline for two consecutive months

Despite improvement in non-manufacturing conditions, significant impact from tariff uncertainty

August outlook worsens... "Opinions of export deferral and order decrease"

Down 0.2p from the previous month to 90.0... Decline for two consecutive months

Despite improvement in non-manufacturing conditions, significant impact from tariff uncertainty

August outlook worsens... "Opinions of export deferral and order decrease"

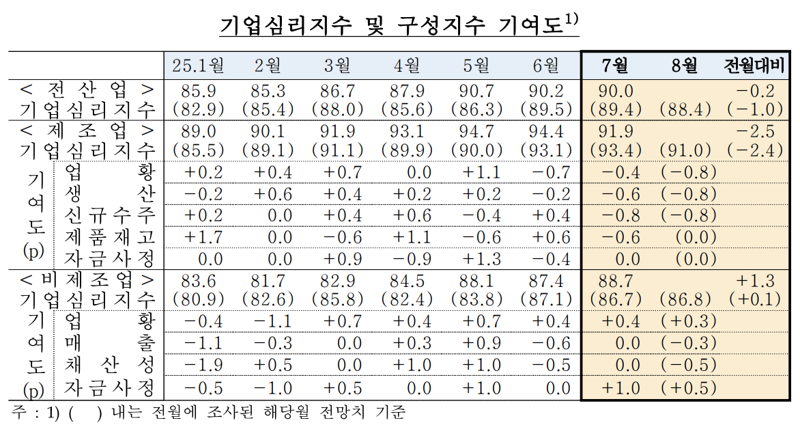

According to the 'July 2025 Business Survey Results (Summary)' released by the Bank of Korea on the 24th, the Composite Business Sentiment Index (CBSI) for all industries this month was 90.0, down 0.2p from the previous month, recording the lowest level since April (87.0).

In May, it rose to 94.7, but the CBSI for all industries has declined for two consecutive months this month, falling below the baseline (100). The CBSI is calculated using major indices (5 for manufacturing, 4 for non-manufacturing) from the Business Survey Index (BSI). A value greater than 100 indicates optimism compared to the long-term average, while a value less than 100 indicates pessimism.

Lee Hye-young, head of the Economic Psychology Survey Team at the Bank of Korea, said, "The business conditions of non-manufacturing industries improved due to demand for data and artificial intelligence (AI) system construction, as well as cooling power demand," but added, "The business sentiment deteriorated as manufacturing declined due to tariff-related uncertainty and the expansion of tariff imposition by item."

By industry, the manufacturing CBSI (91.9) fell by 2.5p compared to June, centered on new orders (-0.8p) and production (-0.6p). It is the largest decline since December last year (-3.8p) with a decrease for two consecutive months.

The non-manufacturing CBSI (88.7) rose by 1.3p as financial conditions (+1.0p) and business conditions (+0.4p) improved. It recorded the highest level since November last year (92.5) with a turnaround to an increase in five months.

The CBSI outlook for next month increased by 0.1p for non-manufacturing (86.8). It improved mainly in electricity, gas, financial and insurance, professional science and technology services, and construction industries. On the other hand, manufacturing (91.0) fell by 2.4p. It deteriorated mainly in electronics, video and communication equipment, metal processing, and chemicals and products. As a result, the CBSI outlook for all industries fell by 1.0p from the previous month to 88.4, recording the lowest level since May (86.3).

Team leader Lee added, "According to the monitoring results by industry, there were opinions that export contracts are deferred or new orders decrease due to the expansion of uncertainty as the results of mutual negotiations related to tariffs have not yet been presented."

The Economic Sentiment Index (ESI), which combines the Consumer Sentiment Index and the Business Sentiment Index, was calculated at 92.9, up 0.1p from the previous month. It is the highest since November 2024 (93). The ESI cyclical fluctuation, which is calculated by removing seasonal and irregular fluctuations from the original ESI series, was 90.9, up 0.6p from the previous month. It is the largest increase since August 2021 (+0.7p).

eastcold@fnnews.com Kim Dong-chan Reporter