"The House Became a Nightmare"... Demanding Return of Deposit, 1 in 3 Houses in 'Reverse Jeonse'

- Input

- 2025-07-23 09:04:57

- Updated

- 2025-07-23 09:04:57

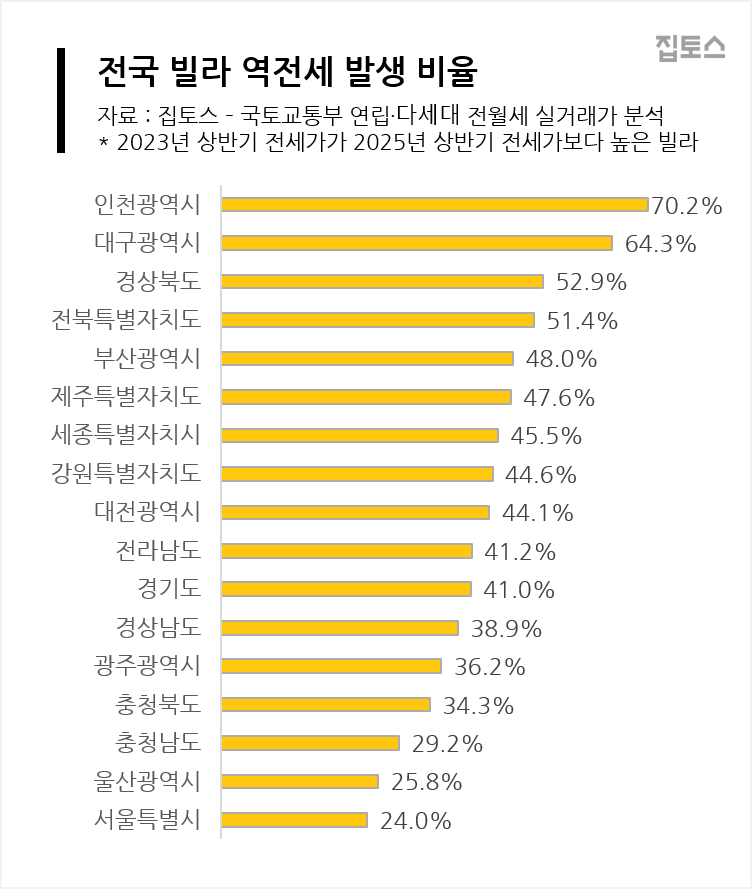

[Financial News] It has been revealed that 1 in 3 villas (multi-family houses) nationwide have experienced a 'reverse jeonse' phenomenon, where the jeonse price has decreased compared to two years ago. This contrasts with the sharp rise in apartment jeonse prices in the metropolitan area during the same period.

According to Jiptos on the 23rd, a comparative analysis of actual transaction data for multi-family houses nationwide in the first half of 2023 and the first half of this year showed that out of 14,550 units with the same size jeonse contracts, 4,641 units, or 31.9%, experienced a decrease in jeonse deposit.

Specifically, the market downturn was pronounced in major metropolitan cities. The jeonse price for multi-family houses in Incheon fell by an average of 7.0% compared to two years ago, and Daegu saw a sharp drop of 9.7%. Other major metropolitan cities such as Busan (-3.5%), Daejeon (-4.3%), and Sejong (-5.2%) also showed a clear downward trend.

On the other hand, Seoul and Gyeonggi saw slight increases of 2.4% and 0.5%, respectively. However, compared to the average increase rate (11.7%) of Seoul apartment jeonse prices during the same period, it is considered virtually flat.

The average decrease in jeonse prices directly correlated with the reverse jeonse occurrence rate. Incheon recorded the highest rate nationwide with 70.2% in a reverse jeonse situation, followed by Daegu (64.3%), Busan (48.0%), and Daejeon (44.1%). The deposit for villas experiencing reverse jeonse also fell. Nationwide, the average deposit decreased from 182.68 million won to 165.18 million won over two years, a drop of 17.51 million won (-10.3%).

Meanwhile, there is an analysis that the recently announced June 27 real estate measures could further increase the downward pressure on the jeonse market for multi-family houses in the future.

This measure includes reducing the limits on support for youth, newlyweds, and newborns' support jeonse loans, which were provided for the stability of housing for the common people. As the limits for these loans have been reduced by up to 60 million won, the burden on villa tenants who mainly use these loans to prepare deposits has increased.

Lee Jae-yoon, CEO of Jiptos, said, "Currently, the rental market is on completely different paths for apartments and villas, with tenants and landlords facing completely opposite risks," adding, "Particularly, the reverse jeonse issue in the villa market could lead to deposit return disputes, requiring special attention from both landlords and tenants."

going@fnnews.com Choi Ga-young Reporter