Did the '6.27 Loan Regulation' Work... Housing Price Expectations Drop to Largest in 3 Years

- Input

- 2025-07-23 06:00:00

- Updated

- 2025-07-23 06:00:00

Bank of Korea Announces July 2025 Consumer Trend Survey

Housing Price Outlook Index Drops 11p to 109 in One Month

Largest Drop in 36 Months Due to Strengthened Household Debt Management Measures

Consumer Sentiment Index Exceeds Long-Term Average for 3 Consecutive Months

"Impact of Improved Consumption and Strong Exports Despite Tariff Uncertainty"

Housing Price Outlook Index Drops 11p to 109 in One Month

Largest Drop in 36 Months Due to Strengthened Household Debt Management Measures

Consumer Sentiment Index Exceeds Long-Term Average for 3 Consecutive Months

"Impact of Improved Consumption and Strong Exports Despite Tariff Uncertainty"

■ Housing Price Expectations 'Plummet' Due to Slowdown in Metropolitan Apartment Prices

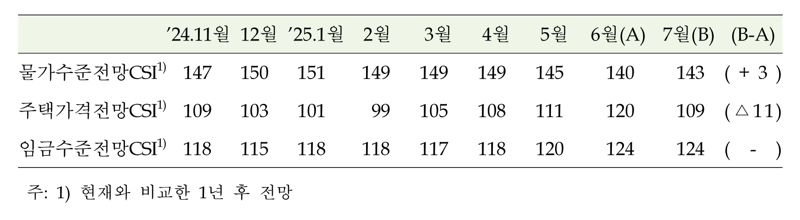

The housing price outlook CSI rebounded from March (105) and continued to rise for four consecutive months until June (120), but turned to a decline for the first time in five months this month. This index exceeds 100 when the number of respondents expecting house prices to rise in a year is greater than those expecting a decline.

This downward trend is the result of expectations for a decline in housing prices following the government's household debt management measures announced on June 27, combined with the recent slowdown in the rise of apartment sales prices in the metropolitan area. Lee Hye-young, head of the economic psychology survey team at the Bank of Korea, explained, “The long-term average of the housing price outlook CSI is 107, and the perspective that it will rise has always been more prevalent,” adding, “As apartment sales prices are on a downward trend recently, the housing price outlook index will also be affected depending on how the real estate market situation changes in the future.”

The expected inflation rate, which represents the forecast for consumer price inflation over the next year, was recorded at 2.5%, up 0.1%p from the previous month. It is the highest since May (2.6%), as the rise in processed food prices continues and the rise in petroleum product prices has turned upward, resulting in an expanded consumer price inflation range. The expected inflation rate three years later remained the same as the previous month, and the expected inflation rate five years later was 2.5%, up 0.1%p from the previous month.

The response proportion of major items expected to affect price increases over the next year was highest for agricultural, livestock, and fishery products (48.0%). This was followed by public utility charges (42.2%), petroleum products (32.7%), and industrial products (32.7%). Compared to the previous month, the response proportion for petroleum products (+12.0%p) increased, while the proportions for agricultural, livestock, and fishery products (-3.5%p) and industrial products (-2.8%p) decreased.

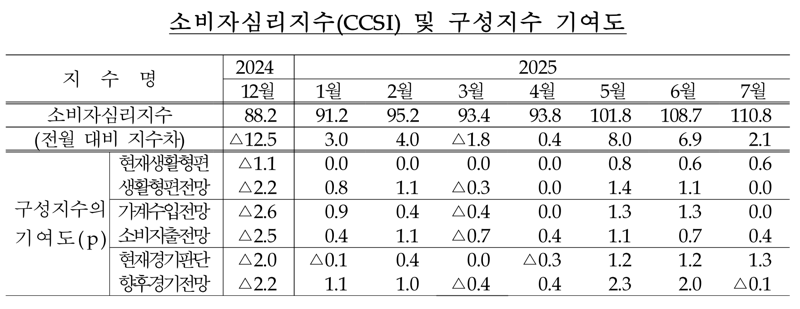

■ Consumer Sentiment at Highest Level in 4 Years and 1 Month Due to Improved Consumption

Since the martial law, the CCSI, which fell below 100 from December (88.2), exceeded the baseline for the first time in half a year in May, and continued to exceed 100 this month, showing an 'optimistic' trend for three consecutive months. The July CCSI is the highest since June 2021 (111.1), marking a peak in 4 years and 1 month.

In detail, among the six indicators that make up the consumer sentiment index, the current economic assessment (86) rose by 12p, recording the highest since June 2021 (94). In terms of the increase, it is the largest since November 2020 (14p).

The current living conditions (94) also rose by 2p due to improved consumption and strong exports, reaching the highest level since June 2018 (94), and the outlook for consumer spending (111) also rose by 1p. The outlook for living conditions (101) and household income outlook (102) remained the same as the previous month, while the future economic outlook (106) fell by 1p.

Team leader Lee explained, “Despite tariff uncertainty, the consumer sentiment index rose slightly compared to the previous month due to improved consumption and strong exports,” adding, “As it has exceeded the long-term average for three consecutive months, it is expected that the improvement in consumer sentiment will have a positive impact on consumption recovery.”

Meanwhile, the interest rate outlook rose by 8p from the previous month to 95. It is the highest since April (96) due to the freeze on the base rate and the increase in housing mortgage loan rates by major commercial banks.

eastcold@fnnews.com Kim Dong-chan