"Competing with High Added Value"... POSCO Holdings Expected to Grow 21.8% Annually, Petrochemical Industry Also Prepares for Rebound

- Input

- 2025-07-22 17:13:24

- Updated

- 2025-07-22 17:13:24

POSCO, Kumho Petrochemical, Expanding High-Profit Product Proportion

Expectations for Reduced Supply from China Also a 'Good Sign' for Industry Rebound

[Financial News] The steel and petrochemical industries, facing a "triple whammy" of global demand slowdown, product price declines, and fixed cost burdens, are seeking a rebound with a differentiation strategy centered on high added value products. POSCO Holdings and Dongkuk Steel are focusing on premium steel products, while Kumho Petrochemical is concentrating on expanding NB latex exports to recover their performance. Additionally, expectations for China's supply restructuring are positively impacting industry improvement.

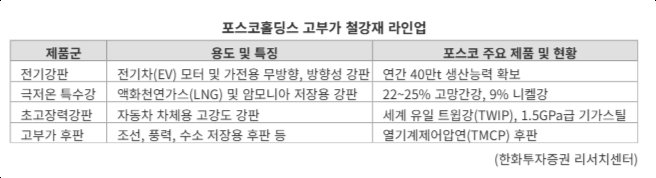

Steel Industry Expanding High-Profit Product Proportion through 'WTP Strategy'

According to financial information company FnGuide on the 22nd, POSCO Holdings' sales and operating profit forecasts for the second quarter of this year are 18.092 trillion KRW and 692.9 billion KRW, respectively. In particular, this year's operating profit is expected to increase by 22.5% compared to the previous year to 2.6618 trillion KRW and expand to 3.9485 trillion KRW by 2027, with an average annual growth of 21.8% expected.POSCO Holdings is seeking a performance rebound through the 'WTP (World Top Premium)' strategy centered on high-profit products such as automotive steel sheets and energy steel materials. WTP is a strategy that consists of more than 30% of total sales volume and more than 50% of sales from high added value products, evaluated as an effective portfolio for performance defense amid global steel demand slowdown.

POSCO Holdings plans to liquidate more than 97% of 126 low-profit businesses by 2026 to secure approximately 2.6 trillion KRW in cash.

A POSCO Holdings representative stated, "By the first quarter of this year, we sold a total of 51 assets, including shares in P&O Chemical and the Mong Duong 2 coal power plant in Vietnam, raising about 950 billion KRW," and "The cumulative cash generation scale will reach 2.1 trillion KRW by the end of the year." The company plans to focus on developing high added value products such as high manganese steel to strengthen competitiveness.

Dongkuk Steel is seeking to improve performance by highlighting differentiated products such as special rebar 'DK Green Bar' and customized section steel 'D-Mega Beam'. As the structure relies entirely on imported slabs, the recent cost reduction effect due to the exchange rate decline is also expected.

The steel market is also showing signs of rebound. Hot-rolled products are expected to see a reduction in imports and price normalization, driven by preliminary anti-dumping rulings in July-August. Heavy plates are also expected to see a rise in distribution prices and a decrease in imports due to provisional tariffs imposed on Chinese products.

China's production cut trend is also noteworthy. In June, China's crude steel production decreased by 9.5% compared to the previous year, and Hyundai Steel and Dongkuk Steel plan to halt operations at their Incheon plant by August, reducing domestic rebar production by about 3.75 million tons. Consequently, rebar prices are expected to rebound, while scrap prices are expected to fall, expanding the long product spread.

Petrochemical Industry Accelerating Structural Improvement with Focus on Advanced Materials

The petrochemical industry is also paying attention to the Chinese government's move to restructure outdated facilities. Recently, the Central Financial and Economic Commission of China and the Hunan provincial authorities are considering shortening the lifespan standard of petrochemical facilities from the existing 30 years to 20 years or closing them upon reaching their design lifespan. As a result, about 20% of China's domestic ethylene production capacity, equivalent to 10 million tons, is likely to be included in the list of facilities to be liquidated. If the central government-led production cuts, as seen in the past steel and aluminum industries, become a reality, global supply-demand improvement effects are also expected.These changes are expected to act as new opportunities for the domestic petrochemical industry. LG Chem increased the proportion of advanced material sales from 4.4% in 2023 to 5.8% in the first quarter of this year, and Lotte Chemical increased it from 25.3% to 28.3%. In particular, Kumho Petrochemical is expected to see a full-fledged improvement in spreads in the second half of the year, driven by increased NB latex exports and price hikes. As inventory adjustments in the U.S. market are completed in the first half, demand is recovering, and as the U.S. virtually halts imports of Chinese gloves, Malaysian products are emerging as substitutes. Kumho Petrochemical, which exports more than 80% of its NB latex to Malaysia, is expected to enjoy the effects of price increases and volume growth simultaneously.

moving@fnnews.com Lee Dong-hyuk Reporter