'Precious' Old DRAM... Prices Triple Amid Last-Minute Demand

- Input

- 2025-07-22 15:23:56

- Updated

- 2025-07-22 15:23:56

Old DRAM spot price surpasses $16

Contrasts with 4.4% rise in new DRAM

Significant impact from reduced supply by global companies

"High prices likely to continue in the second half"

Contrasts with 4.4% rise in new DRAM

Significant impact from reduced supply by global companies

"High prices likely to continue in the second half"

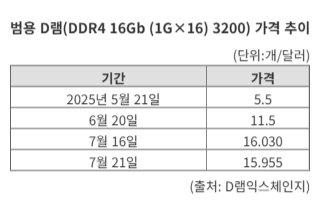

According to market research firm DRAMeXchange on the 22nd, the spot price of the old 'DDR4 16Gb (1G×16) 3200' was $15.955 per unit as of the 21st, a 190.1% increase compared to $5.5 on May 21, two months ago. On the 16th, it even exceeded $16 per unit, the highest level of the year. During this period, the spot price of another generic product, 'DDR4 16Gb (2G×8) 3200,' also rose by more than 103% from $4.248 to $8.634 per unit. Compared to the 4.4% increase in the spot price of the new product 'DDR5 (2G×8) 4800/5000,' which rose from $5.849 to $6.109 per unit over two months, the difference is significant.

The reason for the sharp rise in the price of generic DRAM products is analyzed to be due to the production halt and supply reduction by major global companies, coupled with the stockpiling of inventory and increased demand by IT companies due to the uncertainty of US tariffs. Last year, China, which was pouring out large quantities, also changed its production direction to new (DDR5), and there is an analysis that this atmosphere may continue in the second half of this year.

Samsung Electronics, SK Hynix, and Micron are reportedly planning to halt DDR4 production as early as this year. Sumit Sadana, Micron's Executive Vice President, said last June, "We will end DDR4 DRAM supply within the next 2-3 quarters." This means they will stop supplying by the first quarter of next year at the latest. Earlier in April, Samsung Electronics also reportedly announced that it would not accept DDR4 orders after June. An industry insider said, "While there are talks about the possibility of production expansion due to profitability improvement, changing production lines is not easy, making it virtually impossible."

The uncertainty of semiconductor tariffs imposed by US President Trump is also having a significant impact. If tariffs are imposed, DRAM price increases are inevitable, so IT companies are rushing to secure as much volume as possible before that.

Kim Yangpaeng, a senior researcher at the Korea Institute for Industrial Economics & Trade, said, "The impact of production reduction by global companies is the biggest," adding, "In addition, the downward pressure disappeared as Chinese companies, which supplied quantities at less than half the general price, also reached their limits. Therefore, the market price has normalized, and prices have soared afterward."

The industry expects this trend to continue. Researcher Kim also predicted, "I think high prices will continue in the second half." The variable is whether tariffs will be imposed. If tariffs are imposed, uncertainty will be removed, and the demand for volume by companies may decrease. A semiconductor industry insider predicted, "Companies that use semiconductors are very sensitive to prices," adding, "If tariffs are confirmed, the price of generic DRAM may also fall slightly due to decreased demand."

kjh0109@fnnews.com Kwon Jun-ho Reporter