Hyundai 'Focuses Entirely on US Domestic Market with No Exports from US Factories'

- Input

- 2025-07-20 15:29:42

- Updated

- 2025-07-20 15:29:42

All production from Alabama and Georgia factories for 'domestic use'

Despite tariffs, US sales remain strong... Strategy to expand market share by freezing prices

Despite tariffs, US sales remain strong... Strategy to expand market share by freezing prices

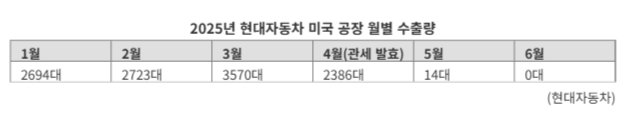

[Financial News] It has been revealed that Hyundai Motor utilized all vehicles produced at its US factories in June to meet local demand. This marks the first time in the past decade, since related data has been compiled, that there were no exports from US factories. Hyundai is focusing all its US production on local demand to minimize price increase pressures from tariffs, while aggressively promoting to expand its market share.

According to industry sources on the 20th, the number of vehicles produced and exported from Hyundai's Alabama factory (HMMA) last month was recorded as '0'. The total number of vehicles shipped from this factory last month was 27,445, all for the US domestic market. The production from the Metaplant America (HMGMA), which began operations in Georgia earlier this year, is also being used entirely to meet local demand.

This is seen as a strategy to minimize the impact of the 25% tariff imposed by the Trump administration on imported cars. Previously, the impact could be avoided with inventory stockpiled before the tariffs, but with inventory running low, the current local production scale is directly linked to the size of the loss.

Although local production is increasing, it is insufficient to cover all US demand. Despite the tariff impact, Hyundai sold 76,525 units in the US last month, a 4.5% increase compared to the same period last year. The local production ratio in the US is around 40%.

Despite increasing price pressure, Hyundai has adopted a 'holding strategy'. While competitors like Ford and Toyota are raising prices, Hyundai aims to freeze prices as much as possible to expand its market share in the US. Meanwhile, it continues aggressive promotions such as discounts and interest-free installments in the US market.

An industry insider said, "The US market is highly sensitive to car prices, so a price increase could lead to a significant drop in sales," and analyzed, "Unlike competitors, Hyundai is trying to increase its presence in the market by freezing prices as much as possible even in the second half of the year."

Currently, the Manufacturer's Suggested Retail Price (MSRP) for Hyundai's SUV 'Tucson' in the US is $28,705, slightly lower than Toyota's 'RAV4' ($29,550). The 'Elantra (Avante)' is also priced at $22,125, cheaper than Toyota's 'Corolla' ($22,325). However, for some models like hybrids, Toyota has a stronger price competitiveness. There is concern that increasing prices to cover losses in the highly competitive US market, where a variety of models are densely packed, could backfire.

However, experts predict that the probability of US tariffs on Korean cars returning to 0% as before is slim. While some reduction is possible, many forecasts suggest that avoiding the bill entirely will be difficult.

Hang-Koo Lee, a research fellow at the Korea Automotive Research Institute, said, "In the automotive sector, some deferral or reduction can be expected, but it will be difficult to avoid tariffs as before," and predicted, "While some losses will be reflected from the second half of this year, the real challenge could come next year depending on the negotiation results."

one1@fnnews.com Jeong Won-il Reporter