International Finance Center: "US Immigration Restrictions May Hinder South Korea's Global Business Expansion"

- Input

- 2025-07-20 13:53:04

- Updated

- 2025-07-20 13:53:04

Anti-immigration law leads to reduced consumption in Latin America and Asia

Labor shortages in low-wage sectors in the US become a reality

Wage increases stimulate US inflation... Global economic contraction

Concerns about restrictions on global business expansion of Korean conglomerates

Labor shortages in low-wage sectors in the US become a reality

Wage increases stimulate US inflation... Global economic contraction

Concerns about restrictions on global business expansion of Korean conglomerates

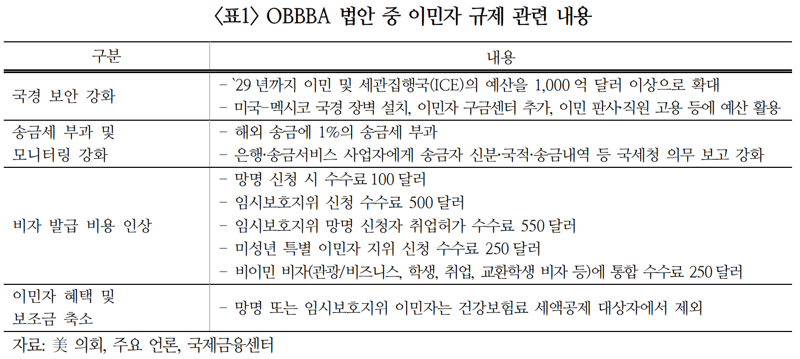

According to the International Finance Center's report on the 20th, titled 'Impact and Implications of US Immigration Regulations on Emerging Markets,' the Trump administration's large-scale tax cuts and spending reduction bill (OBBBA), implemented on the 4th, includes many policies unfavorable to immigrants, such as strengthening visa issuance requirements and reducing Medicaid spending. A 1% remittance tax and a $250 'Visa Fraud Prevention Fee' have been newly imposed on overseas remittances, and additional regulations such as bail hearing procedures for illegal immigrants have been announced, increasing the likelihood of long-term immigrants, who were previously almost unrestricted, being detained and deported.

The report analyzed that US regulations could affect both individuals and companies through immigrant employment paths, potentially causing growth slowdowns in neighboring countries. It pointed out that policy constraints, such as the rejection of visas for expatriates and restrictions on research collaboration, hinder technology transfer in emerging countries, especially as the imposition of remittance taxes could lead to a deterioration of the current account and stimulate consumption contraction.

The global economic burden is also expected to expand further. The economic sentiment contraction in emerging countries due to anti-immigration laws is intertwined with labor shortages in the US. Low-wage sectors, concentrated with Latin American and Asian workers, are difficult to replace in the short term, which could stimulate US inflation due to wage increases. Despite ongoing reshoring efforts, the level of foreign employment in the US is higher than that of nationals, leading to continued labor shortages and wage increases, which may prompt global companies to consider relocating production bases back to emerging countries.

Kim Mi-seung, the chief researcher at the International Finance Center who wrote the report, explained, "As anti-immigrant sentiment in the US strengthens, economic concerns among emerging market consumers and companies increase, and labor market instability spreads." He added, "As Elon Musk, CEO of Tesla, and Melania Trump, the wife of Trump, are also naturalized citizens, the US government's strengthening of immigration regulations could act as a factor increasing political anxiety among naturalized citizens."

The burden on our economy is also expected to increase. The proportion of US operations among Korean conglomerates' overseas subsidiaries expanded from 22.1% in 2022 to 23.2% in 2023, and rose to 25.8% by June last year. In this situation, there is growing concern that restrictions on global business expansion could occur due to rising labor costs and subsidy reductions in some industries due to immigrant blockades.

Chief Researcher Kim emphasized, "Last year, the proportion of Korean students receiving higher education in the US was 35%, higher than in other countries," and "It is necessary to closely monitor US immigration law-related policies and side effects, not only for corporate US subsidiaries but also for students."

eastcold@fnnews.com Kim Dong-chan Reporter