'From Banks and Insurance to Securities' Retirement Pension Inflows 1 Trillion Won in 8 Months

- Input

- 2025-07-20 12:00:00

- Updated

- 2025-07-20 12:00:00

[Financial News] It was reported that more than 1 trillion won of retirement pension funds moved from banks and insurance companies to securities companies within 8 months since the start of the retirement pension transfer service. Many individual funds flowed from banks to securities companies seeking higher returns. The government is set to launch the 'Retirement Pension Transfer Pre-Check Service' on the 21st, allowing individuals to check in advance whether they can transfer their retirement pension to their desired provider.

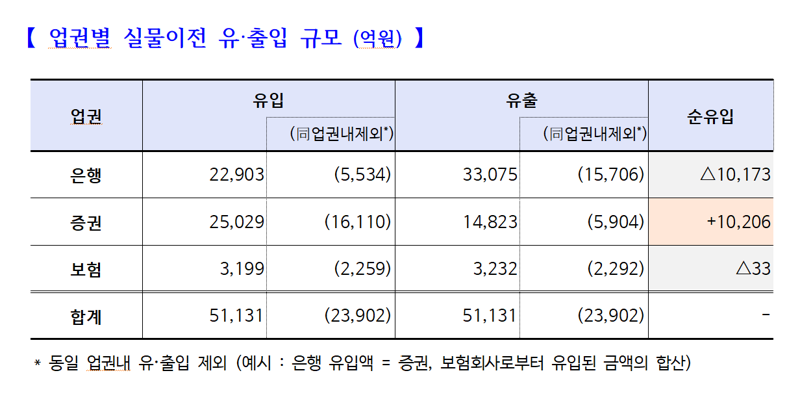

According to the 'Retirement Pension Transfer Status Statistics' announced by the Financial Supervisory Service and the Ministry of Employment and Labor on the 20th, a net inflow of 1.002 trillion won was recorded from banks and insurance companies to securities companies from October 30 last year to June 30 this year. Banks and insurance companies saw net outflows of 1.017 trillion won and 3.3 billion won, respectively.

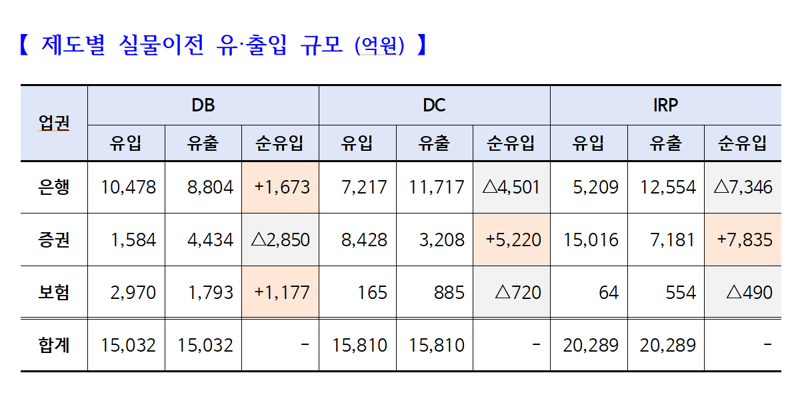

By system, the individual retirement pension (IRP) saw the largest money movement. While 783.5 billion won flowed into securities companies, 734.6 billion won and 49 billion won flowed out from banks and insurance companies, respectively. In the defined contribution (DC) type, 450.1 billion won and 72 billion won were withdrawn from banks and insurance companies, respectively, and 522 billion won moved to securities companies.

Conversely, in the defined benefit (DB) type, funds moved from securities companies to banks and insurance companies. Of the 285 billion won that left securities companies, 167.3 billion won and 117.7 billion won went to banks and insurance companies, respectively.

The government stated, "The retirement pension transfer service has established itself as a convenient service for subscribers, recording 87,000 cases and 5.1 trillion won in usage over about 8 months," and announced the launch of the 'Retirement Pension Transfer Pre-Check Service' on the 21st.

Previously, in the transfer service, subscribers had to open an account with the retirement pension provider they intended to transfer to and apply for the transfer before confirming if the transfer was possible. This led to inconvenience when it was later confirmed that the transfer of the held product was not possible, resulting in the cancellation of the transfer or termination (cash-out) of the product.

With the newly launched pre-check service, subscribers can simultaneously check the transferability of their held products with multiple retirement pension providers, such as banks, securities, and insurance, and choose the provider they wish to move to based on the inquiry results.

The government stated, "Subscribers can easily check the transferable products of each retirement pension provider without opening an account in advance," and "It is expected that the convenience for subscribers will improve, their choices will expand, and healthy competition in the retirement pension market will be promoted."

Subscribers who wish to transfer their retirement pension account using the transfer method can apply for the 'Retirement Pension Transfer Pre-Check' through the menu on the website or mobile app of the retirement pension provider (transfer company) they are already subscribed to. Subscribers can select their held retirement pension account and designate the provider they wish to inquire about.

The transfer company will receive the subscriber's application, send the list of held products to the companies to be inquired, and provide the inquiry results to the subscriber through the website by the next business day after the application.

However, it should be noted that the pre-check for transfer is only available online and cannot be applied for offline, such as by visiting a branch. The application and result inquiry for the pre-check service can only be done through the retirement pension provider where the account is already opened, and inquiries cannot be made at the company you wish to move to.

After confirming the results of the pre-check for transfer, if you decide to proceed with the transfer, you must select one retirement pension provider, open a retirement pension account, and submit a separate transfer application form from the inquiry application.

sjmary@fnnews.com Seo Hyejin Reporter