"Operating Profit Ends 3-Year Decline"... Kolon Industries, Expected to Grow 16% Annually Riding on mPPO

- Input

- 2025-07-20 15:32:35

- Updated

- 2025-07-20 15:32:35

Investing 34 billion won in high-performance resins for semiconductors and automotive electronics

Starting to recover profitability through business internalization

[Financial News] Kolon Industries is expected to break the three-year streak of declining operating profits and begin a full-fledged growth of around 16% annually starting this year. Especially from next year, the company plans to accelerate its high-value-added specialty materials strategy by unifying its business structure from production to sales, focusing on modified polyphenylene oxide (mPPO), a high-performance material for semiconductors and automotive electronics.

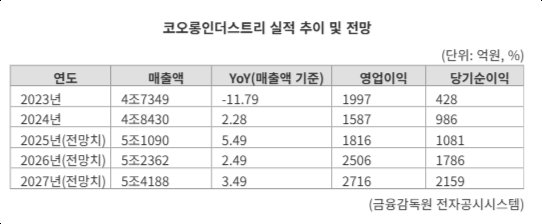

According to the industry on the 20th, Kolon Industries' sales and operating profit for this year are expected to be 4.843 trillion won and 1.587 trillion won, respectively. Sales have slightly increased compared to the previous year, but operating profits have been on a decline for three consecutive years since 2021. In fact, Kolon Industries' operating profit consistently decreased from 2.527 trillion won in 2021 to 2.425 trillion won in 2022 and 1.997 trillion won in 2023. However, the securities industry views this year as the bottom of the performance and expects a full-fledged rebound trend to appear from next year.

According to the average estimates presented by major securities firms over the past three months, Kolon Industries' operating profit is expected to gradually recover to 1.816 trillion won in 2025, 2.506 trillion won in 2026, and 2.716 trillion won in 2027. The average annual growth rate during this period is approximately 16%. Sales are also expected to recover to the 5 trillion won level next year and continue to increase for four consecutive years until 2027.

The center of the performance rebound is mPPO, a high-value-added epoxy resin material. Previously, it was a dual structure where Kolon Life Science produced and Kolon Industries sold, but from this year, it has been converted to a single corporate system to strengthen business internalization.

mPPO is highly suitable for high-spec electronic materials such as 5G, semiconductor packaging, and automotive multilayer substrates due to its excellent electrical insulation and heat resistance. It is attracting attention as a core material in the industry structure where demand for low dielectric copper clad laminate (CCL) is increasing, with electrical blocking performance 3-5 times superior to conventional epoxy.

Kolon Industries is investing about 34 billion won to establish a dedicated mPPO production line at its second plant in Gimcheon, Gyeongbuk. It aims to complete construction in the first half of next year, and after completion, annual sales of several hundred billion won are expected. Global mPPO demand is expected to more than double from 4,600 tons this year to 9,700 tons by 2030.

In particular, mPPO is evaluated as a material with high technical barriers that makes it difficult for latecomers to enter, allowing it to target both the general-purpose market and the differentiated high-profit market simultaneously. A Kolon Industries official said, "mPPO is a field where there is still a technological gap with China," adding, "We will proactively respond to the electronic materials market and increase the proportion of high-value-added products to enhance profitability."

Meanwhile, the main growth product, aramid fiber, is also showing signs of a full-fledged rebound. The export price per ton of aramid hit a low of $14,400 in April and successfully rebounded to $15,400 in May.

The background for the recovery in demand is cited as the expansion of 5G networks centered on the United States and China. The global aramid market, which continued negative growth until last year, rebounded to a growth rate of 5% this year. The facility utilization rate also recovered from 50% in the second half of last year to 70% in the second quarter of this year. As demand recovery and productivity improvement coincide, expectations for a rebound in the performance of aramid fiber, which is used in various industries such as communication cables, brake pads, tire cords, and bulletproof materials, are also rising.

moving@fnnews.com Lee Dong-hyuk Reporter