Hanwha Solutions Expects 5-Fold Jump in 2Q Results... Renewable Energy Operating Profit Forecast at 180 Billion

- Input

- 2025-07-21 05:29:00

- Updated

- 2025-07-21 05:29:00

Benefiting from IRA and AMPC, North American Exports Recover

Turning to Profit Despite Chemical Slump

Turning to Profit Despite Chemical Slump

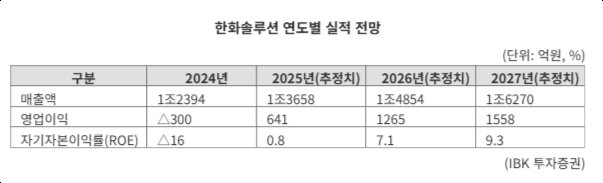

[Financial News] Hanwha Solutions is expected to turn a profit in the second quarter of this year, driven by the recovery of solar demand in the USA and the benefits of the Advanced Manufacturing Production Credit (AMPC). Particularly, the renewable energy sector is emerging as the core driver of the group's overall operating profit, leading the performance in the second half of the year.

According to financial information company FnGuide on the 21st, Hanwha Solutions' operating profit for the second quarter is expected to be approximately 122.7 billion won. This marks a turnaround from the previous quarter's operating loss of 30.3 billion won, representing a more than fivefold increase.

The main driver of performance improvement is the renewable energy sector, centered around Hanwha Q CELLS. IBK Investment & Securities estimated the operating profit of this sector for the second quarter at 185.2 billion won. In contrast, the chemical sector recorded an operating loss of 61 billion won, and the advanced materials sector recorded an operating profit of 12 billion won, leading to the assessment that Q CELLS effectively drove the overall performance.

The key factors behind this performance rebound are the recovery of solar demand from the USA and the increase in AMPC prices. With the implementation of the Inflation Reduction Act (IRA), tax credit benefits within the USA have expanded, and the impact of tariff increases has kept local solar module prices at a high level. Consequently, solar module demand in the North American market is on a recovery trend, significantly improving profitability.

The residential solar business has already exceeded last year's annual performance with just the first quarter results of this year. Particularly, as the tax credit for the third-party ownership (TPO) model is maintained until 2027, and with the bankruptcy and management difficulties of local competitors, Hanwha Solutions' market share is rapidly expanding.

This trend is clearly reflected in the performance. According to Hanwha Solutions' quarterly report, the Q CELLS division's first-quarter sales amounted to 2.0843 trillion won, a 60.6% increase compared to the same period last year (1.2981 trillion won). Operating profit also turned from a loss of 125 billion won last year to a profit of 161.1 billion won this year, emerging as the only profitable business within the group.

Positive changes are also detected in terms of the global supply chain. Recently, the Chinese government ordered a 30% production cut for major material producers such as polysilicon and solar glass this month. This measure aims to curb oversupply and reorganize outdated facilities to induce quality improvement, which is expected to help stabilize solar module costs and recover profitability.

Meanwhile, concerns have been raised that some wind power projects may face disruptions due to the passage of the 'Big and Beautiful Bill (OBBB)' under the USA's IRA law. However, as the solar-related tax credit (AMPC) remains valid until 2032, the prevailing assessment is that related uncertainties are limited.

moving@fnnews.com Lee Dong-hyuk