Strengthening the Role of the Insurance Industry is Necessary to Achieve New Government Policy Goals

- Input

- 2025-07-14 16:04:32

- Updated

- 2025-07-14 16:04:32

The Insurance Research Institute emphasized through the 'Insurance Industry Policy Grand Debate' held on the 14th at Shilla Stay in Haeundae, Busan, that "to effectively support the government's policy goals, the insurance industry must function as a more proactive policy tool."

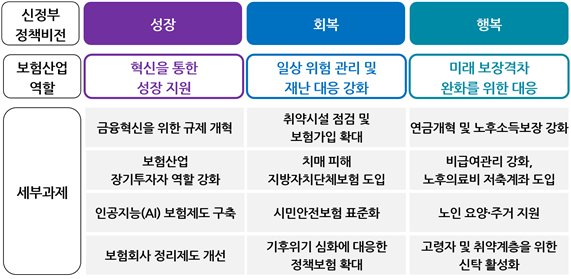

The institute presented the direction for strengthening the role of the insurance industry centered on three axes: △support for innovation-based growth △strengthening response to everyday risks and disasters △resolving future protection gaps.

First, it was stated that bottom-up financial innovation led by the private sector is needed in response to the development of advanced technology. It is difficult for the industry to fundamentally develop with only a top-down approach led by the government under the current rigid financial regulatory system. In particular, it was emphasized that it is urgent to prepare an AI-based insurance system in line with technological trends.

Furthermore, the institute pointed out the need to resolve the protection gap due to the deepening of aging. The institute mentioned that "although the pension reform plan (premium rate 13%, income replacement rate 43%) has passed the National Assembly, it still fails to resolve the financial instability of public pensions," and that "additional measures for financial stability, such as further increases in premium rates and inducement of low-income group enrollment, are necessary."

The institute also suggested that the abolition of the severance pay system and the introduction of the UK-style automatic enrollment retirement pension system should be promoted to revitalize personal pensions.

In the medical field, it was pointed out that the current non-covered management system is worsening the loss ratio of indemnity insurance. It was viewed that excessive medical treatment should be curbed by resolving information asymmetry about non-covered prices and effects and strengthening the evaluation and review system.

The issue of asset protection for the elderly and cognitively vulnerable groups was also raised. The institute stated that the activation of insurance claim rights trusts is necessary as an institutional device to protect the increasing cognitively vulnerable groups such as elderly dementia patients and people with developmental disabilities. This is to ensure the financial soundness of the elderly and social safety devices simultaneously.

Regarding everyday risk and disaster response, it was conveyed that disaster blind spots should be resolved by inspecting vulnerable facilities of small-scale industries and expanding insurance enrollment. It was stated that the coverage level and insured risks of citizen safety insurance should be standardized nationwide to enhance institutional equity and that the system should be established as a basic national disaster guarantee system.

coddy@fnnews.com Ye Byeong-jeong Reporter