"Divide and Combine"... Pharmaceutical and Bio Industry Maximizes Efficiency

- Input

- 2025-07-14 15:11:11

- Updated

- 2025-07-14 15:11:11

Enhancing Expertise and Maximizing R&D Performance

Securing Long-term Growth through Restructuring

Improving Finance and Competitiveness through Restructuring

Securing Long-term Growth through Restructuring

Improving Finance and Competitiveness through Restructuring

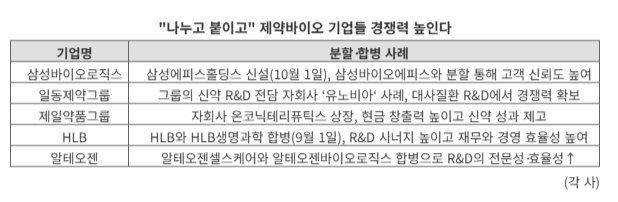

[Financial News] Recently, in the pharmaceutical and bio industry, maximizing efficiency through corporate division and merger has emerged as a new strategic keyword. It is analyzed that this is to enhance management expertise and business focus while securing synergy across the board, including the most important research and development (R&D).

According to the industry on the 14th, Samsung Biologics recently embarked on a strategy to reorganize its governance structure by separating Samsung Bioepis. By reorganizing Samsung Bioepis, which was a subsidiary of Samsung Biologics, under the newly established Samsung Epis Holdings, the aim is to eliminate concerns about conflicts of interest with global big pharma clients.

Through this corporate separation, Samsung Biologics will fundamentally block the possibility of confidential information leakage in drug manufacturing. This is evaluated as a measure to enhance customer trust and secure long-term business stability.

The division will be implemented with the launch of the new company on October 1, and Samsung Epis Holdings will have Samsung Bioepis as a 100% subsidiary. The bio industry sees this as an opportunity to further solidify Samsung's position in the global contract development and manufacturing organization (CDMO) market.

Cases of securing independence and expertise simultaneously are also active in the pharmaceutical industry. Ildong Pharmaceutical Group has separated its new drug R&D dedicated subsidiary Yunovia for independent operation. Yunovia recently unveiled excellent clinical results of the obesity and diabetes treatment candidate 'ID110521156' at the American Diabetes Association (ADA).

ID110521156 is a low-molecular oral synthetic drug, expected to be a differentiated drug with superior productivity and ease of use compared to existing injectables.

Jeil Pharmaceutical is highlighting new drug achievements by separating and listing its subsidiary Onconic Therapeutics. Onconic successfully commercialized the gastroesophageal reflux disease treatment 'Zacubo', achieving sales of 14.8 billion won last year, establishing itself as a profitable bio company, and set this year's sales target at 24.9 billion won, a 54% increase from the previous year.

In addition to division, merger activities are also active. HLB plans to maximize management efficiency by integrating R&D assets through a merger with its subsidiary HLB Life Science. The merger is expected to be completed by September 1, with expectations for flexibility in new drug development and capital utilization based on synergy effects.

Alteogen also integrated its subsidiaries Alteogen Healthcare and Altos Biologics to launch 'Alteogen Biologics'. It has consolidated capabilities in drug development, distribution, and sales, aiming to enhance R&D expertise and efficiency through the integration of clinical development and new pipeline.

It is analyzed that division and merger are key to business concentration to secure technology and market trust, as well as synergy creation by combining research capabilities and distribution power.

An industry official said, "In the pharmaceutical and bio industry, quickly commercializing R&D achievements and operating them expansively is most important, and mergers and divisions play a crucial role in such capabilities," adding, "Restructuring is a process of changing a company's DNA, so careful yet bold execution must be combined."

vrdw88@fnnews.com Kang Jung-mo Reporter