Reasons for the Surge in Debt Adjustment Applications... "One in Four Can't Repay Due to Job Loss or Business Closure"

- Input

- 2025-07-14 14:23:22

- Updated

- 2025-07-14 14:23:22

Debt adjustment increased by over 40% in two years

Over 100,000 applications in the first half of this year

Many defaults due to job loss, business closure, or income reduction

Over 100,000 applications in the first half of this year

Many defaults due to job loss, business closure, or income reduction

On the 14th, according to data received from the Credit Recovery Committee by the office of Cha Gyugeun, a member of the National Assembly Planning and Finance Committee from the Joguk Innovation Party, the number of individual debt adjustment applicants last year was 195,032. This is a 41.1% increase in two years from 138,202 cases in 2022.

Debt adjustment is a system that extends repayment periods, adjusts interest rates, and reduces debts for those who find it difficult to repay financial debts due to financial hardship. It is categorized into rapid debt adjustment (less than one month of delinquency), pre-workout (1-3 months), and personal workout (more than 3 months) depending on the delinquency period.

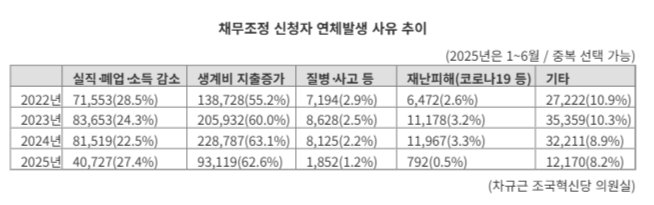

The problem is that the number of debt adjustment applicants is also significantly increasing this year. In the first half of this year (January to June 2025) alone, there were already 103,317 applicants, surpassing 100,000. The proportion of those applying for debt adjustment due to 'job loss, business closure, or income reduction' fell from 28.5% in 2022 to 22.5% in 2024, but rebounded to 27.4% this year. The proportion of respondents citing 'increased living expenses' as a reason also increased from 55.2% in 2022 to 62.6% this year.

In contrast, responses citing 'illness or accident' as a reason for delinquency decreased from 2.9% in 2022 to 1.2% in the first half of this year. Those who selected 'disaster damage such as COVID-19' as a reason for delinquency reached 3.3% last year but sharply declined to 0.5% in the first half of this year. The proportion of those driven to debt adjustment due to income reduction from economic recession is increasing compared to responses citing personal reasons or external variables.

By age group, the 40s, the most economically active age group, accounted for the largest proportion at 27.1%. This was followed by the 50s (24.2%), 30s (21.1%), and 60s (12.6%). The proportion of those under 20 was 11%, and those over 70 was 4.1%.

A significant number of debt adjustment applicants have a monthly income of less than 2 million won. This year, 11,675 applicants had a monthly income of less than 1 million won, and 55,296 applicants had a monthly income of 1 to 2 million won, accounting for 64.7% (66,971 people) of the total.

Cha Gyugeun said, "Labeling the bad bank (long-term debt adjustment organization) as promoting moral hazard shows a lack of understanding of reality," adding, "It is more reasonable to see that delinquencies occur due to changes in economic conditions while maintaining livelihoods with low income, rather than deliberately avoiding debt repayment."

He continued, "As there are many young people among the debt adjustment applicants, helping them quickly return to economic activities through debt adjustment will benefit the national economy."

eastcold@fnnews.com Kim Dongchan Reporter