'Finance' ETF Ranks High in Growth... 9 Out of Top 10 Are 'Securities·Banks'[ETF Square]

- Input

- 2025-07-13 15:07:03

- Updated

- 2025-07-13 15:07:03

[Financial News] In the domestic Exchange Traded Fund (ETF) market, finance-related ETFs such as securities and banks have taken the top spots in growth rates. On the other hand, agricultural ETFs and European carbon emission-related ETFs showed a downward trend.

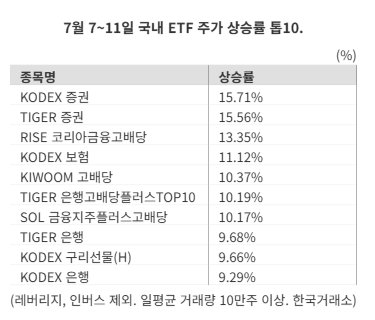

According to the Korea Exchange on the 13th, the product that recorded the highest return in the ETF market from the 7th to the 11th was 'KODEX Securities', which rose by 15.71%. It was followed by 'TIGER Securities (15.56%)', 'RISE Korea Financial High Dividend (13.35%)', and 'KODEX Insurance (11.12%)' in the top ranks. Leverage, inverse items, and items with an average daily trading volume of less than 100,000 shares were excluded from the tally.

The items that took the top spots are finance-related items such as securities and banks. Recently, financial companies have shown a significant rise in growth rates due to expectations of improved performance in the second and fourth quarters and expanded shareholder returns. Among the top 10 items in growth rates during the same period, except for 'KODEX Copper Futures H (9.66%)' which ranked 9th, all 9 items are finance-related ETFs.

Experts believe that the rally of finance-related items will continue in the second half of the year. The government's tax reform plan, including the separation of dividend income taxation, is expected to be announced at the end of this month, accelerating institutional reforms to revitalize the capital market.

Sunho Kwon, a researcher at IBK Investment & Securities, said, "With the passage of the Commercial Act amendment, additional policies such as mandatory share buybacks and expansion of separate dividend income taxation have been announced, increasing expectations for shareholder returns," and "The expansion of separate dividend income taxation not only increases the preference for dividends but also alleviates the gap in interests between major shareholders and general shareholders."

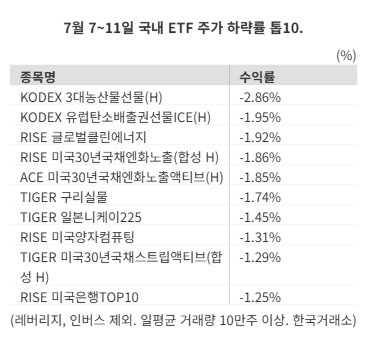

On the other hand, agricultural ETFs and European carbon emission ETFs showed a downward trend. 'KODEX 3 Major Agricultural Futures (-2.86%)', 'KODEX European Carbon Emission Rights Futures ICE (-1.95%)', and 'RISE Global Clean Energy (-1.86%)' formed the top ranks in decline rates.

Agricultural ETFs, which invest in representative agricultural products such as corn, soybeans, and wheat, are considered a representative investment defense tool. Although the investment sentiment favoring safe assets was formed due to the conflict between Israel and Iran last month, showing growth rates, it is interpreted that the decline occurred as the situation stabilized again.

Due to US President Donald Trump's reduction of energy subsidies, global ETFs related to eco-friendly energy also showed a downward trend. The US Congress passed the 'One Big Beautiful Bill (OBBBA)' on the 3rd (local time), which includes the early termination of electric vehicle tax credits. The bill significantly reduces the 30% tax credit benefit for solar and wind power projects, which were scheduled to operate until 2032.

Experts point out that the bill makes it difficult to promote new solar and wind power projects. It is analyzed that jobs dependent on subsidies will disappear and consumer prices may increase nationwide.

koreanbae@fnnews.com Bae Hangul Reporter