Last Year's Travel Deficit with Japan 'Largest Ever'... 'Yen's Butterfly Effect Continues'

- Input

- 2025-07-13 14:28:10

- Updated

- 2025-07-13 14:28:10

Travel payment increase with 900 won-level won-yen exchange rate

Record number of Korean tourists visiting Japan last year

Tourism expected to continue this year with October's golden holidays

"Deficit expected to expand with new routes to Japan"

Record number of Korean tourists visiting Japan last year

Tourism expected to continue this year with October's golden holidays

"Deficit expected to expand with new routes to Japan"

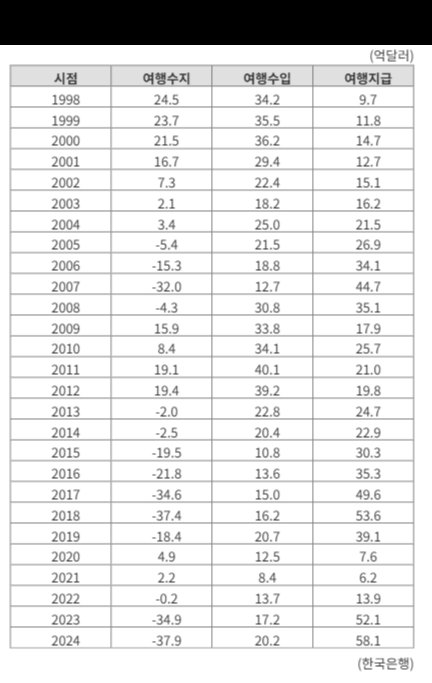

This is because the travel payments by Korean tourists visiting Japan increased significantly compared to the travel income from Japanese tourists visiting Korea. Last year's travel income was 2.0195 billion dollars, about 300 million more than the previous year (1.7175 billion dollars), but travel payments rose from 5.2122 billion dollars to 5.8129 billion dollars, an increase of over 600 million during the same period. Particularly, travel payments surged more than nine times compared to three years ago in 2021 (623 million dollars), reaching the highest level ever since the statistics were compiled.

The background to the surge in Korean travel to Japan is the record low won-yen exchange rate. The won-yen exchange rate dropped sharply for four consecutive years from 1,105.3 won in 2020 to 900.8 won last year. The annual won-yen exchange rate was below 900 won only in 2006 (821.3 won) and 2007 (790 won).

Song Jae-chang, head of the Financial Statistics Department at the Bank of Korea, explained, “The demand for travel to Japan was higher than to the US and Europe due to the weak yen effect,” adding, “In response, low-cost carriers adjusted their flights from Jeju routes to Japan routes.”

The difference in the number of tourists was particularly noticeable last year. According to the tourism industry, the number of Japanese tourists visiting Korea last year was recorded at 8.82 million, a 26.7% increase compared to the previous year. The total number of foreign tourists visiting Japan last year was 36.9 million, with Koreans accounting for the largest share (23.9%). In contrast, the number of Japanese tourists visiting Korea last year was 3.22 million, falling short of the 3.27 million in 2019 before the COVID-19 pandemic.

The problem is that the travel deficit with Japan is likely to continue this year. According to the Japan National Tourism Organization (JNTO), the cumulative number of Koreans visiting Japan from January to May this year reached 4.05 million.

In particular, in May, which had many holidays such as Children's Day, Koreans ranked first among the 3.6933 million overseas tourists entering Japan, with 825,800 Koreans. Considering the golden holidays in October, including Chuseok, National Foundation Day, and Hangul Day, the number of Korean tourists visiting Japan this year is likely to surpass last year's record level.

The behavior of Japanese tourists visiting Korea is contrasting. According to the Korea Tourism Data Lab, the repeat visit rate of Japanese tourists visiting Korea last year was 72.5%, the lowest in six years since 2018 (70.2%). The average length of stay was also 3.7 days, the lowest since related statistics began in 2015. This is why travel income is sluggish compared to the soaring travel payments.

If the travel deficit continues, it will inevitably put downward pressure on the domestic current account balance this year. This is because the travel deficit reduces the current account surplus by expanding the service account deficit. In fact, more than half of the 2024 service account deficit (-23.7 billion dollars) occurred in the travel account (12.5 billion dollars). Moreover, if money that should be spent domestically is spent in Japan, the pace of domestic demand activation will slow down.

Director Song said, “With the won-yen exchange rate continuing in the 900 won range and the weak yen persisting for a long time, the expansion of new routes to Japan such as Incheon-Narita and Incheon-Toyama is also expanding the infrastructure for travel to Japan, with related travel products being launched,” adding, “Considering the structural preference for short-distance travel, the travel deficit with Japan is expected to continue.”

eastcold@fnnews.com Kim Dong-chan Reporter