Panel Prices Plummet Amid Cooling TV Market... Samsung and LG's Second Half Performance Depends on 'Premium'

- Input

- 2025-07-21 15:34:06

- Updated

- 2025-07-21 15:34:06

July TV Panel Prices Drop Across the Board... 32-inch Down 2.8% Compared to Previous Month

Demand Slump Leads Brands to Drive Prices... Panel Makers Pressured to Lower Prices

2Q Forecast: Samsung VD Operating Profit Halved, LG MS Division Expected to Post Loss

Focus on Premium and High-Value Strategies to Defend Profits

Demand Slump Leads Brands to Drive Prices... Panel Makers Pressured to Lower Prices

2Q Forecast: Samsung VD Operating Profit Halved, LG MS Division Expected to Post Loss

Focus on Premium and High-Value Strategies to Defend Profits

[Financial News] The global TV market downturn that began in the first half of this year continues into the second half, with TV panel prices stalling this month. As TV demand weakens, panel makers are losing pricing power, and prices are being adjusted downward in response to TV brands' demands for price cuts. Due to the TV market slump, major domestic TV manufacturers Samsung Electronics and LG Electronics are struggling to defend their profits, and both companies are putting all their efforts into expanding their premium product lines as a countermeasure.

■Panel Makers Can't Raise Prices... TV Market Slump

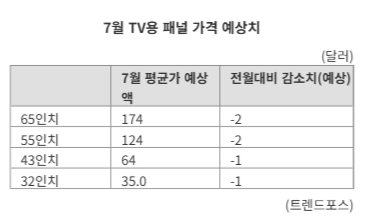

According to market research firm TrendForce on the 21st, the price of a 32-inch TV panel (LCD standard) in July this year is expected to be $35, down $1 (2.8%) from the previous month. Prices for major models such as 43, 55, and 65 inches also fell by about $1 to $2 each. From April to June, there was no price change for 32, 43, 55, and 65-inch panels compared to the previous month. However, it is expected that TV brands will reduce orders in the third and fourth quarters to adjust inventory, and panel manufacturers are responding to brand-side requests for price cuts, increasing downward pressure on prices.

A domestic home appliance industry official said, "In a situation where TV demand is generally stagnant, it is difficult for panel makers to stick to prices unconditionally," adding, "If set makers struggle, panel makers also find it difficult to unilaterally hold pricing power, and prices are ultimately formed through coordination between brands and manufacturers."

For TV manufacturers, the drop in panel prices is positive in terms of easing cost burdens in the short term. However, as the market itself is practically stagnant and TV demand is declining, there are concerns about the limitations in improving profitability. According to market research firm Omdia, TV shipments this year are expected to be 208.7 million units, a decrease of 0.1% compared to the previous year.

■Premium TVs and Services as a Solution

As the TV market shrinks, competition among companies, including low-cost offensives from Chinese companies, is intensifying, increasing the burden on domestic companies Samsung Electronics and LG Electronics. The TV business performance of both companies has already faltered. According to the securities industry, the video display (VD) division responsible for Samsung Electronics' TV business is expected to have recorded an operating profit of 113 billion won in the second quarter, a decrease of half compared to the same period last year. It is known that the VD division has entered an emergency management system this year, considering organizational restructuring. LG Electronics also cited "demand contraction in the Media Entertainment Solution (MS) business division" as the reason for its poor second-quarter performance. The MS business division is expected to have recorded a deficit in the second quarter.

Given the situation, both companies plan to actively defend their performance in the second half through premium strategies. Samsung Electronics plans to increase its market share by focusing on premium TVs, including OLED TVs. Yong Seok-woo, head of Samsung Electronics' VD division (president), said at a conference held in April this year, "Many people predict that (TV) volume growth will be difficult this year," adding, "We plan to expand the portion focusing on premium."

LG Electronics plans to further solidify its leadership in the premium product line and strengthen its differentiation strategy by enhancing the competitiveness of its proprietary operating system, webOS. In the second half, it plans to further solidify the leadership of its premium product line, OLED TV, with the launch of new wireless products, while continuously strengthening the competitiveness of the webOS platform by expanding various new content such as games and art. soup@fnnews.com Lim Soo-bin Reporter