"China initiates 50 million ton production cut"... Korean steel industry expects rebound in second-half performance through adjustment of operating rates

- Input

- 2025-05-29 08:00:00

- Updated

- 2025-05-29 08:00:00

Global price stabilization due to China's supply reduction

Expectations for margin improvement and profitability recovery in the second half

Expectations for margin improvement and profitability recovery in the second half

[Financial News] As China's steel production cut policy becomes more concrete, the domestic steel industry is also accelerating its supply-demand adjustment. With the reduction trends of both countries intersecting, there is anticipation for a reduction in global supply pressure, and domestic steel companies are seeking a rebound in second-half performance by adjusting operating rates and pursuing a strategy of high-value products. Although cost pressures such as industrial electricity rate hikes and iron ore price increases remain, if the recovery trend of steel prices supports it, the scope for profitability improvement could expand.

According to the industry on the 29th, there is a possibility that the Chinese government will undertake a steel production cut of up to 50 million tons this year. Amid the restructuring trend due to the carbon neutrality policy and the high tariff pressure from the United States and the European Union (EU), expectations are growing for the resolution of supply excess centered on general-purpose materials and the rebound of global steel prices.

Goldman Sachs recently predicted in a report that China's steel exports will decrease by 3% this year and that the reduction will expand to one-third by 2026.

Next year, China's crude steel production is expected to decrease by more than 10% compared to when the production cut policy was introduced in 2020, reaching approximately 946 million tons. Especially with the sluggish exports and weak domestic demand, China's steel production is expected to decrease by 2% this year and 3% next year.

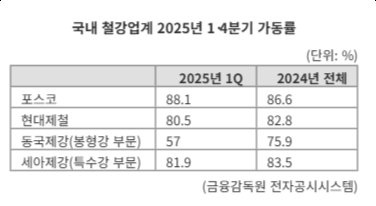

Amid the global supply reduction trend, domestic steel companies are also adjusting production volumes to prepare for profitability recovery. In fact, the average operating rate of the top three companies, POSCO, Hyundai Steel, and Dongkuk Steel, was 79.8% last year, down 4.6 percentage points from the previous year, and this trend continues in the first quarter of this year.

Hyundai Steel's operating rate in the first quarter was 80.5%, below last year's average (82.8%), and SeAH Steel's special steel operating rate also fell to 81.9% from 83.5% the previous year. On the other hand, POSCO has increased its operating rate from 86.6% last year to 88.1% in the first quarter of this year through a production strategy centered on high-value products such as cold-rolled, coated, electrical steel, and stainless steel (STS), defending its profitability.

Electric furnace-based companies are also increasing the scale of production cuts. Dongkuk Steel lowered its rebar and section steel operating rate from 75.9% last year to 57% in the first quarter of this year and plans to suspend operations at its Incheon plant for a month in line with the industrial electricity rate hike scheduled for July-August. This is interpreted as a preemptive response to maintain the supply-demand balance of rebar and section steel.

The industry expects that if China's production cut policy continues, the pressure on general-purpose material prices will ease, and the high-value strategy of domestic steel companies will become more prominent. Especially if the recovery of demand in the second half becomes full-fledged in line with the expansion of global infrastructure investment, the rebound in performance could be significant.

Lee Jae-yoon, a research fellow at the Korea Institute for Industrial Economics and Trade, said, "If China undertakes production cuts, iron ore prices could fall first," adding, "Since product prices are already at a low level, profitability recovery through margin improvement is possible."

Meanwhile, small and medium-sized steel companies are concerned about the burden of fixed costs and the decline in facility utilization due to prolonged production cuts. With the overlap of industrial electricity rate hikes and the rise in iron ore prices, there are also observations that the performance gap due to differences in strength could widen.

Researcher Lee pointed out, "If the operating rate decline of electric furnace-based companies is prolonged, they need to reconsider the scale of facilities themselves, and if the blast furnace-based companies face difficulties in supply-demand adjustment, there could be limits to responding if the recession is prolonged."

moving@fnnews.com Lee Dong-hyuk Reporter