Consumer Sentiment Recovers to Pre-Martial Law Levels... "Expectations for New Government's Economic Stimulus Expanding"

- Input

- 2025-05-27 15:15:47

- Updated

- 2025-05-27 15:15:47

Consumer sentiment improved at the largest rate in 4 years and 7 months

Impact of resolving political uncertainty and expectations for US tariff suspension

Expectations for housing prices continue... "Due to the rise in metropolitan area apartment prices"

Impact of resolving political uncertainty and expectations for US tariff suspension

Expectations for housing prices continue... "Due to the rise in metropolitan area apartment prices"

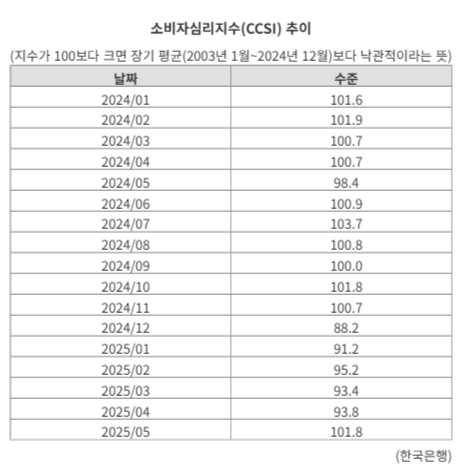

[Financial News] The Consumer Confidence Index (CCSI), which indicates consumers' perception levels of the economy, showed the largest increase in 4 years and 6 months. This was due to the spread of expectations for the new government following measures such as the suspension of reciprocal tariffs by the United States and the formulation of a supplementary budget.

According to the consumer trend survey released by the Bank of Korea on the 27th, this month's CCSI was 101.8, up 8p from the previous month. It reached the highest level in 7 months since October last year (101.8), surpassing the 100 mark for the first time since November last year, just before the martial law incident. The increase compared to the previous month was the largest since October 2020 (12.3p).

CCSI is a psychological indicator that comprehensively reflects consumers' sentiments about the economic situation. It is calculated using 6 major indices out of 15 CSI, and if it is greater than 100, it means consumer sentiment is optimistic compared to the long-term average (2003-2024), and if it is below 100, it is pessimistic.

Lee Hye-young, head of the economic psychology survey team at the Bank of Korea, explained, "The consumer sentiment index has greatly improved as negative factors such as political uncertainty and US tariff policies, which have been constraining consumer sentiment recovery, have eased." She added, "There was also some base effect due to the low level of the index so far," and "Since it reflects future economic expectations, we need to watch if this trend continues."

Compared to the previous month, all 6 indices that make up the CCSI rose. The outlook for living conditions rose by 5p to 97, and the current living conditions and household income outlook each rose by 3p to 90 and 99, respectively. In particular, the outlook for future economic conditions (91, +18p) and the current economic assessment (63, +11p) jumped by double digits. This is attributed to the expectation of progress in the supplementary budget plan passed by the National Assembly and the Korea-US tariff negotiations.

Meanwhile, expectations for rising house prices continued this month. The housing price outlook consumer trend index rose by 3p from the previous month to 111. It has been on the rise for three consecutive months since February this year, reaching the highest level since November last year (109). This index exceeds 100 when the number of respondents expecting house prices to rise in a year exceeds those expecting a decline.

Team leader Lee said, "The housing price outlook index is greatly influenced by the current real estate market," adding, "As the upward trend in apartment prices in the metropolitan area continues, more people are expecting real estate prices to rise."

eastcold@fnnews.com Kim Dong-chan Reporter