After the Presidential Election, the Stock Market Arrow Points to 'Small and Mid-Cap Stocks'... Policy Benefits Reignite

- Input

- 2025-05-29 17:02:56

- Updated

- 2025-05-29 17:02:56

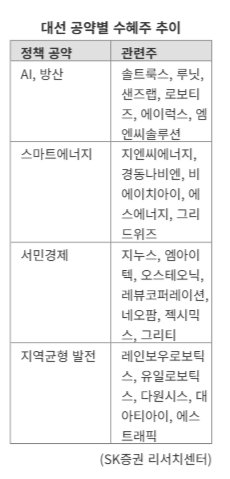

[Financial News] With the 2025 presidential election as a turning point, there are forecasts in the securities industry that the policy rebound cycle of small and mid-cap stocks in the stock market will begin in earnest. It is analyzed that preemptive attention to related stocks is necessary in areas such as artificial intelligence (AI), defense, smart energy, domestic demand and welfare, and regional balance development, which are expected to be the industrial development directions of the next government.

SK Securities researcher Na Seung-du said on the 29th, "As the policy sensitivity of the market increases ahead of the presidential election, the concentration on large-cap stocks may gradually ease," adding, "Some small and mid-cap stocks that have been structurally undervalued are being noted as awakening stocks due to policy justification and potential for performance recovery."

Market participants predict, "The next government is likely to propose industrial transformation based on AI as a major policy," adding, "Initially, the hardware (HW) industry centered on semiconductors will attract attention, but in the mid to long term, software (SW)-based AI companies in areas such as medical, security, and defense will be at the center of benefits."

Researcher Na analyzed, "With the advancement of AI technology, the mid to long-term growth potential of derivative application SW companies such as medical AI, security AI, and defense AI is being highlighted," adding, "The expansion of the defense budget is likely to lead to indirect benefits centered on the localization of materials and parts and maintenance and repair (MRO) rather than weapon exports."

As the power demand across the AI, electric vehicle, and semiconductor industries increases rapidly, the smart energy infrastructure theme supporting this is also being re-evaluated, focusing on small and mid-cap stocks. In particular, the expansion of energy storage systems (ESS) and smart grids is expected to benefit from policy linkage, as it is difficult to realize without policy support. From the perspective of power policy, as the parallel policy of nuclear power and renewable energy is maintained, the structural growth expectations of small and mid-sized companies with power storage and utilization technology may increase. In addition, if the next government designs policies aimed at expanding welfare for the working class, youth, and the elderly, and stimulating domestic demand, the cost-effective consumption and welfare-type domestic demand themes may be re-highlighted.

After the presidential election, the possibility of implementing a supplementary budget and interest rate cuts is also being highly anticipated. DB Securities researcher Kang Hyun-ki predicted, "If stimulus measures for economic recovery are implemented, the increased liquidity could stimulate real estate prices and show a positive trend in construction industry stock prices." He added, "The valuation of the retail and distribution sectors also remains at historically low levels, and the derivative consumption potential resulting from the rise in real estate prices due to stimulus measures could drive up related stock prices."

dschoi@fnnews.com Choi Du-seon Reporter